With the year coming to an end, i have decided to split the reviewing into 2 parts.

The first part consist of what went well, what did not go well and general thoughts.

While the 2nd part will be more on the 2022 returns portion.

(One of the things I manage to do in 2022 was to go Korea to catch a concert)

General Thoughts

It has been nothing short of a strange and volatile year, with news of interest rate rising along with inflation rates, the world scrambles to respond to higher prices which is felt from a larger scale such as more expensive loan rates to the smaller scale of increase in prices of food and drinks.

In any general finance theory, the increase discount rate will cause a reduction in valuation of companies and those who are unable to pass on cost due to inflation (for example unable to add price in a competitive market yet having to pay more to attract the workers to do the same work) will also suffer in reduced profits.

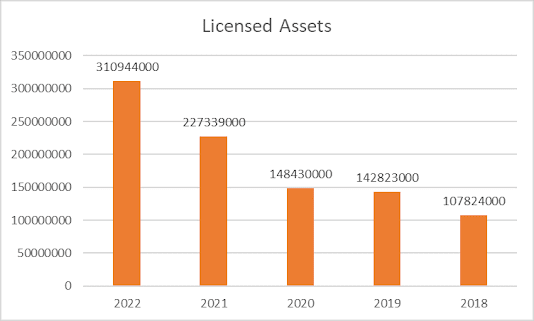

On the China Front, we kicked off the year being covid zero with other parts of the world slowly opening up. Unfortunately, the lockdowns are happening very often and demand remains lacklustre which has resulted in many companies recording 30 to 50% fall in share prices while property companies took a even higher fall while some went into suspension.

Suspended List include Giants such as Shimao Group and Sunac which had a market cap of 92 and 120 billion in December 2020. In 2020, they are worth around 5 and 8 SATS Holdings at today's price.

While those that are not suspended did not really do well in share price either. Some notable ones include

With the exception of Yuexiu Property which is state-owned, the rest have fared pretty bad with highest being 90% loss in its share price. Even my favourite road king is not being spared.

Surprisingly, the contagion has not impacted SGX Markets as Yanlord Land remains resilient. The key difference would probably be the selling price per sqm for Yanlord being much higher and they do have a few investment properties as buffers.

In Singapore, it has been a resilient year, the opening is around 3200 points and we are still at that level despite some highs of 3400 and lows of 2900.

I guess the main fears of Singaporean would probably be:

1) How to grow wealth amidst the many different possible sources suddenly having black swans e.g hodlnaut.

2) Handle rising loan rates while having to wait long time for BTOs.

3) Job-hopping while trying to make sure that the new job would not be cut off during a recession should such situations arise.

4) Coping with inflation and increase in food prices , gst etc.

I still remain my stand that buying t-bills and ssb is not suitable for me as i see them as volatility reducers in the portfolio and not investment return generators.

Trades that went well this year in 2022

1) Human Health Holdings (Hkex 1419) Bought at 1.18 in Jan and sold at 2.24 in Feb on the back of Covid-19 cases rising in HK and the need for compulsory testing and vaccination. More can be found on the 2 writeups here and here

2) Samudera Shipping (SGX: S56) Bought at 0.795 in July and Sold at 1.22 in August) Previous writeup on this lucky purchase can be found here

3) Sold off / Cut loss on Johnson Holdings and WKK Intl after former had poor contract wins and latter had performed well below my expectations. Sold off at 0.98 and 0.91. The price as of 8 December is 0.66 and 0.68.

4) Cut loss on IGG. Sold off at 5.17 in January on the back of the profit alert on its poor performance. Current Share Price 2.98.

Trades that went bad this year in 2022

1) Selling of Prop Services Company CC New Life (Hkex 9983) and Yuexiu Services (Hkex 6626). Sold them at 2.3 and 2.51. The current price is 3.77 and 3.25 respectively.

2) Hotel Grand. Bought 0.985 and Sold at 0.98. The macro research on trends and number of tourism did not really seep into this company which reported a lousier bottomline and poor top line as well.

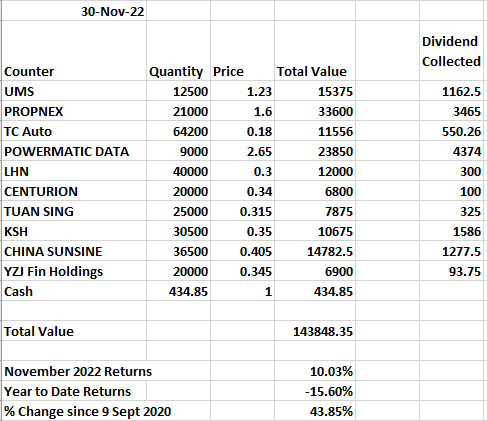

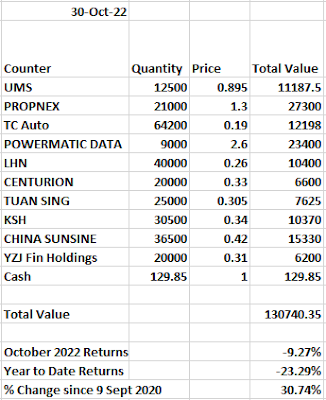

The rest that is on my portfolio, some were purchased at a higher price than current prices, it remains to be seen if they will turn sour in the last weeks of the year or in 2023.

Overall so far, i have sold more than i bought this year, which means that there is net capital outflow currently. I hope to make it negative by a token amount to show that i have put in more money compared to last year if i can get the companies i want at what i think is a ok valuation.

In terms of transactions frequency, this year's frequency is fewer than 2021 which is expected as there are other things to do as well such as travelling and when markets fall, averaging down adding is more common and there is less incentive to try a couple of trades here and there unless i am more confident.

However, the transaction value is close to 1.9x of what is in 2021 which means that there has been larger movements in the portfolio. This is in line with what i wanted to achieve. Since June after my first flight since 2020. I promised myself to be more active and try my best for the rest of 2022 before deciding on further actions.

(Just me taking a highly zoomed shot like at least 16-20 times on a Samsung S22 Ultra)