Motivation for Investing

-To start things off, i entered 2021 with my motivation for investing at a new low ever since i started investing back in late 2014. As such, i find myself ending 2021 with a even lower motivation than the start of the year.

-Mainly it is due to a lot of non investing related personal issues (e.g my favourite k-pop group disbanded being 1 of them and another friend that i have met with this year has left the world in this year.) that has plagued my thoughts on whether i should continue doing it on such level of attention given.

-With lower motivations, there is less times i ask myself if i should change my portfolio or add new positions. I guess i will leave it open for what i want to do moving forward. Perhaps a new spark of motivation might come, i would never know but i don't feel upbeat anyway.

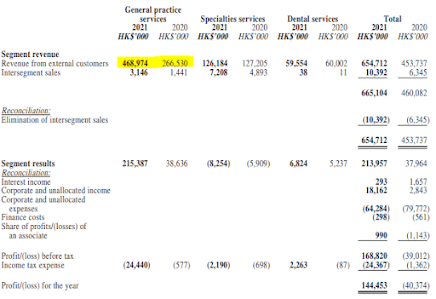

(2021 Returns: 11.04% as the top 3 positions remain unchanged. Lost to STI ETF but comfortably beat the Hang Seng Index or the small cap Hang Seng Index.)

(For folks which are keen in XIRR)

-Returns for 2021 as above. Personally i feel that the year is acceptable as i have hit the base target i have set and i have not put much effort into changing the portfolio.

-As such the returns are largely driven by previous years ideas. Though there are a couple of cut-loss that i have done that have saved a couple of % of more losses.

-The portfolio's top 3 positions at end 2021 are pretty much the same as in end 2020.

Hindsight 100/100 (Look back with a 100ml of vinegar)

Top 7 moves that might make me look good this year (some might make me look bad the next year...)

1) Added Shinvest at 2.36 in May

2) Added AAG Energy at 1.11 in July

3) Added more Ocean Line Port Development (Hkex: 8502) at 0.231-0.237 in Feb and sold off Ocean Line Port Development at 0.3 to 0.33 in July

4) Ballot for Temasek Bonds and Sold on opening day. Same for Astrea as well.

5) Ballot for TC Auto in November. IPO Price 0.23 and made a profit from it.

6) Sold off KWG Group for 12.2 in Feb. Had bought it at average price of 14.5 in Aug 2020 but it has paid a stock dividend of around 3.24.

7) Selling Central China Real Estate at 1.83 in July. It has hit below 1 in December.

Top 7 moves that might made me look like an idiot this year

1) Buying Uni Asia at April at 0.65 and selling the same amount at 0.66 in May. It is around 1.2 in December

2) Buying Samudera Shipping in Jan at 0.26 and selling it at Feb at 0.245. It is around 0.55 in December

3) Buying Logan Group at 12.54 in April and selling it at 10.4 in July. Looking back it is 5.86 now so the play is stupid but could have been worst.

4) Buying Central China Management at 2.63 in May, 2.24 in June, 1.9 in July and 1.59 in December . It is around 1.4 in December. This stocks is 1 of the highest loss% in the portfolio currently.

5) Additions this year underwater (Central China New Life and Management , IGG and Hong Kong Johnson) Especially Hong Kong Johnson, purchased in Sept 2021 and it is down 25% already in December.

6) Buying Ka Shui International at 0.58 in Feb and Selling it at 0.64 in March. It is 0.78 in Dec and has hit a high of 1.24 in December

7) Buying OTS Holdings at 0.32 in August only to sell it again in August at 0.31. Somehow the research work is clearly wrong as the results is lacklustre.

As you can see, my timing in positions is muchly flawed and very much i am emotional as well. There is plenty to work on and to improve on.

However, i believe that paying attention o my investment thesis and checking if the company matches the thesis with its results and the surrounding environment that might affect the company's results are more crucial.

If i were to rate myself for my 2021 performance, a solid 5.1/10. An acceptable year but a very far distance away from what i can do in previous years and when i have higher motivations.

Thoughts on my positions (5% Weightage and above)

1) Shinvest (2021 Share Price Performance: -3.50% )

-Continues to be a value play that is pertinent on the management's decision making. The outlook of its financial assets (Espressif being listed in China Tech Board with ticker of 688018 is doing well in terms of financials and has a good prospect.). Although the fair value of the company changes very frequently, a 20% upside from its current price is the minimum i would anticipate. However a lot of it depends on the management's decisions.

(Volatility of Espressif can be seen in its share price change in 2020)

2) AAG Energy (2021 Share Price Performance: +8.46% )

-A company that has done fairly decent regardless of natural gas price. This is due to the regulations by government for natural gas prices that is piped towards neighborhood. Recent price has been very volatile due to misconception that the company benefits largely from natural gas increases. However, it benefits only slightly as a small amount of gas sold is close to market price. Majority of discussion for prices are set 1-2 times a year hence a general increase in price level will lead to a higher price when discussed.

-In terms of productivity, cost of producing gas has came down over the years for both its fields of Panzhuang and Mabi. The point of focus will be how much more cost it can be lowered for Mabi and when the volume increase for Mabi will occur as currently 95% and above of profits comes from Panzhuang.

(Despite Selling Prices not at the highest level, 1H 2021 has already done better than previous years half year due to increase in volume and cost control)

(Cost has been coming down for Panzhuang which is one of the reasons for its improving bottom line in 1H 2021. From 0.31 in 2017 to 0.19 in 1H 2021, it is at very low levels and is probably 1 of the best in the field in China)

(Much will be on Mabi's development and whether cost can continue coming down. From 1.38 in 2017, it has reached 0.77 in 1H 2021. However given Panzhuang's figures, there is still the possibiltiy of lowering cost, just how much more and how fast would it be possible)

(As seen in this slide, Panzhuang currently makes up 90% of the production. Which means that most of the revenue and profit contribution comes from Panzhuang. Mabi is still in developmental stage.)

3) Tat Seng Packaging (2021 Share Price Performance: +26.23% )

-With new leadership and board members at Hanwell, the proposed spin-off has been called off and as such a lot on how the share price will perform will likely be on the dividend for full year and its results.

-While paper prices have kept a healthy level without much fluctuations, peers listed in China have produced 3Q 2021 Results that are poorer than 3Q 2020. However, the Tat Seng is currently still trading below book value and a relatively low PE of less than 8.

4) Mainland Headwear Holdings (2021 Share Price Performance: +80.90% )

- A company that has its progress hindered by Covid-19. As such its ramp-up of production in 2019 was not reflected in 2020. However, it has recovered on the back end of 2020 and in 1H 2021 it has managed to earn more than 2019 in total. This has led to a very nice increase in share price in 2021.

-PE still remains at a single digit level and company still remains cheap. Considering Covid risk and its location of Bangladesh, its understandable. Further upsides will be unlocking value in its Shenzhen land as production is mostly shifting towards Bangladesh as well as workers being more skilled and productive over time leading to a better financials.

-Company has been hiring and productions in 2H 2021 seems to have been uninterrupted hence the results this year is likely to be decent.

5) Central China New Life (2021 Share Price Performance: -21.44% )

- A company that has fallen a lot in 2021 due to the impact of property development companies in China being affected by regulations and poor housing sentiments.

-My personal view has not changed, it is 1 of the few companies that has not used its funds for any large acquisitions yet since IPO. This might prove to be a masterstroke decision making as its peers who has done acquisitons have suffered quite a large drop in share price. Whether the company makes use of the depressed environment to conduct acquisitions will be key.

-Its parent company going bust will still be a concern. However, considering that the PE of companies that has been acquired recently such as color life is around 10 PE. The company is currently trading at an implied PE of around 9 and has around 1.5 PE worth of net cash. As such, it is trading at fire sale valuations already.

(From 6.3 level at start of year to around 4.9 in December)

6) IGG (2021 Share Price Performance: -14.66% )

- A company that has performed badly in financials and share price. Its poor financials is a result of its increased spending in manpower to develop games while the share price performance can be attributed to both internal( needs more time to prove its strategy works) and external(poor macro environment for gaming stocks).

- Flagship game Lords Mobile has tapered down in 2H 2021 compared to 1H 2021. Its 2 newer games Dress Up Time Princess and Mythical Heroes has had good debuts but DUTP has came down in revenue rankings in past months and it remains to be seen if the management can bring it back up.

-For Mythical Heroes it has only came out in November and therefore time is needed to observe. The largely anticipated game 'Yeager' a game that is like monster hunter will have its 4th beta on 28th December. As such, it is probably safe to say that we could have to wait longer to see it translate to anything meaningful on its top and bottom line. An interesting thing is that PC Version will be available hence if this is anything half of a Genshin Impact then it would be daebak.

(Lords Mobile in 2H of 2021 has clearly done not as well compared to 1H)

(Widely lauded as their 2nd flagship game at the 1H 2021 Results Briefing, the game has also done not as well in recent months in revenue ranking)

(Yeager from IGG)

7) Hong Kong Johnson Holdings (2021 Share Price Performance: +45.71% )

(But i am sitting at about -20% currently)

- Company released its Mid-Year results in November. Results to me look ok. However share price had a decrease of around 20% since then hence i took the opportunity to added some and it has squeezed its way to having around 5% of the portfolio.

-Contract wins in 2021 represent a small increase over contract expired in 2021 hence revenue for 2H 2021 is likely to be acceptable. Main bulk of renewals come in 2022 and hence it remains to be seen if how many is renewed and at what rate. As such, the low implied PE of around 4-5 that it is currently trading is understandable.

-I believe 2022 will be a crucial year in terms of renewals and that will set the tone for its revenue for 2022,2023 and 2024 as contracts tend to last around 3 years.

(Contracts up for grabs. 3 Ticks represent current contracts Johnson holds that will expire in 2022)

8. Uni Asia Group (2021 Share Price Performance: +108.47%)

(But i am sitting at about +10% currently as i did not hold it since last year end)

- Shipping rates have came down but it is still at profitable levels. Will see how shipping rate goes in the new year and what the management does with regards to distributions.

-The rest of the segments should be nothing outstanding or horrendous to be looking out for.

(Sending Hearts and Wishing Everyone a Happy New Year)

Year to Date Returns Chart (Peak in September. Fortunately it is positive for large parts of the year)

For anyone interested to see the range of returns for the porfolio in 2021.