Friday 30 July 2021

(July Results) How i would invest in the singapore stock market if i had 100k of spare money

Tuesday 13 July 2021

Recent Additions 6626 HK, 2343 HK

Added 2 positions recently. However both are small positions, they add up to a total of around 4.6% of the portfolio.

Added

Yuexiu Services (6626 Hkex)

and

Pacific Basin (2343 Hkex) , part of the 10% moomoo trading game.

Divested

Logan Property (3380 Hkex) , part of the 10% moomoo trading game as it made a 10% loss.

Rationale of adding Yuexiu Services

1. Uniqueness - Integrated Metro Property Management with the ability to manage a huge range from train stations/ train depots to shopping malls and residential property.

2. Strong Shareholder - With Guangzhou govt being a shareholder, it is likely a strong front-runner for future government property management projects

3.Attractive Valuation - Based on 2020 PE, it is trading at around 31 PE, which is definitely not attractive for a relatively smaller size property management company, However, considering that it has improved revenue by 75.4% and gross profit by 93.9% in the first 4 months of 2021 compared to 2020, i estimate a doubling of profit and this would bring the PE down to around 15, which is attractive for me to enter as i believe it would be able to grow further given that the metro property management acquisition was done only in November 2020 and the full year contribution will be shown in 2021 as well as a good gap of around 51% between contracted GFA and GFA Management (which indicates that there is currently 51% GFA in the pipeline to be managed in future)

Key Risk

1. Although it should be a beneficiary of Covid as it is involved in sanitization of properties that it managed, it could incur too much cost or do too much 'charity' and affect earnings

2. As it is a newly ipo-ed stock, it might face volatile trading volumes and ipo price being at the lowest end of the valuation might indicate that it might face near-term pressures until

As such, i have decided to enter a small position and will average down if the share price falls further and the valuation holds.

1. Market Leader. Being a market leader of the handysize industry, it benefits most from a rising handysize market

2. Low new orderbook. According to its slides, the handysize is at 3.5% of existing fleet which is the lowest and this bodes well as it means lesser future supply. To put things in perspective, the orderbook in 2009 was 46% and 39% in 2011.

3.Improved pricing of 2nd hand handysize dry bulks. This means that there is increased optimism of the dry bulk market.

4.Improved Market Conditions. Handysize index has been on a rise since year to date($26000 in July 2021) and it has beaten 2010 levels of $22000 seen in 2010. Although someway off the $48000 level in 2008, this is still a significantly better condition than previous years.

Key Risk

1. Volatility in Dry Bulk Market. As it is a commodity driven market, it can be expected to be very volatile and if the index is to start plunging, the profit would follow.

2. Priced-in Valuations. 92.86% increase in price year to date, it can be said by some that it is already priced-in and one should consider other dry bulk companies that has increased lesser.

3. Poor forward cover. Given the huge rise in rates recently, it is largely expected the forward rate estimate given to be good. A poor forward cover (due to overly locking rates too early in the year) might result in share price to fall.

As such, i have decided to enter a small position and will consider average down if the share price falls further and the index holds.

With 1H results out on 29 July 2021, it will be interesting to see how it pans out.

Saturday 3 July 2021

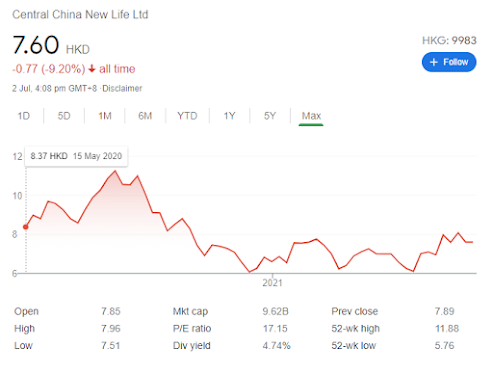

1 Year Holding CC New Life (HKEX: 9983) but still making a loss :(

The current price as of 2 July 2021 is CC New Life is 7.60.

Compared to my first purchase price, i am actually in a loss 1 year on. In fact the stock has languished at even lower levels throughout the year. However, i remain optimistic of the company.

What resulted in the weak results so far in the year?

1) Initial Hype over property management companies

Companies were trading at close to 40 and 50 PE during the early and mid of 2020. This resulted in a lot of hype. However following the hype, the smaller and mid property management companies tanked following the lack of volume.

2) Too many new listings of Property Management Companies

As a result of this, the exclusivity and uniqueness of companies start to become blurred and funds start to go towards different property management companies. In 2020, at least 14 property management companies have been listed, with larger management companies being listed such as Sunac Services, Evergrande Property Services and China Resources Mixc Lifestyle.

How would i view property management companies

I feel that at a PE of 30, its acceptable if the growth year on year is 50% for at least 2 years.

One might ask how a growth of 50% year on year is possible. The following are some possible reasons off my head.

1) Increased Prices of Property Management Fee

-The current prices vary across different cities in China and varies according to the type and age of residential properties as well. As it is still highly regulated by the governments of each city, a cap is set on the amount that can be charged. Removing this charge will allow for better growth.

2) Increased Economies of Scale

-Managing more properties in the same city with centralized control center will result in better cost savings and economies of scale. For example, using the same maintenance team for more residential projects instead of having 1 for each project will allow for lower cost.

3) Increased Scale of Management

-Revenue = Price x Demand. In this case, increasing demand will be to increase the amount of properties managed to drive growth

4) Increasing Value-added Services

-The profit margin of value-added services are higher than the property management margins. However, different property management companies offer different types of value-added services. The more common value-added services include consultancy services to property developers, real estate services and house-related services.

5) Increased Mix of Properties Managed

-Commercial Properties have a higher management fee charged compared to residential properties and such as have a higher margin. By increasing the amount of commercial properties managed, this would allow for a higher profit.

To sum it up, to drive growth, a good property management company should have a good relative value preposition.

As there are too many companies in the market currently, one would have to ask if the property management company they have picked provides a good value preposition.

In picking a big property management company vs a medium/small, one would have to consider that the valuation difference is present and at times the lower liquidity can drive prices to a low such that it does not match the valuation.

Value Prepositions and the relevant companies that I know of.

- Scale ( CG Services Hkex: 6098) The parent company of CG Services is Country Garden Holdings, the largest property developer in China. It has also shown resilience in raising capital as it issued new shares amounting to 4.55% of issued share capital at a price of $75.25 per share in May and the company as of 2 July, trades at $79.95, which is above the issued price.

- Commercial Properties (China Resources Mixc Lifestyle Services Limited Hkex: 1209) 42.7% of Revenue from Commercial Property Management. (KWG Living Group Hkex: 3913) 30% of Revenue from Commercial Property Management. (Sunac Services Hkex: 1516) 29.9% of Revenue from Commercial Property Management. (SCE Commercial Management Hkex: 606) 46.3% of Revenue from Commercial Property Management.

- Service ( Shimao Services Hkex: 0873) Obtained 1st for satisfaction level in Q1 2021.

- Volatility (Evergrande Services Hkex: 6666) High volatility due to parent company Evergrande's ability to service debt in recent times. Evergrande is also the 2nd largest property developer in China.

- 3rd Party Properties being managed ( CC New Life Hkex: 9983) 48% of Managed GFA are 3rd party properties

- Metro Property Management Concept (Yuexiu Services Hkex: 6626) A company largely based in Guangdong, with the Guangdong Government having a stake in the company via its Guangzhou Metro. Provides management services(including sanitary services) for train depots and train services as well as properties owned by Guangzhou Metro that are developed along the metro line.

- Fast Growth Target ( Times Neighborhood Hkex: 9983) Targetted for around 70% core net profit growth in 2021 and around 50% in 2022 and 2023 in a virtual property conference held in June

Lastly, I do apologize for any misspelling or formatting of sentences as this was done while waiting for Euros to begin in the early morning hours.