To start off, the post will be offensive to certain people who are reading it. Hence if you cannot afford to be offended then please refrain from reading further.

However, if you feel that you might have been offended after reading then i truly apologize.

1st Investing Thought (Least Provoking)

Pacific Basin 3rd Quarter Trading Update (Hkex 2343)

Pacific Basin released its 3rd Quarter Update on 13 October 2021. Details can be found here

Just in case you have forgotten, Pacific Basin is a company that operates dry bulk, mainly in the Handysize and Supramax segment. It is the largest listed company for Handysize.

The rates for 3rd quarter results came in to be widely in-line with my own expectations. The rates have always been lagging the spot market this year due to lag time. This is not an issue as in the event a down market happens, the rates would have reversed.

(Handysize coming in at 29k for October but Spot is around 30k)

(All in all still the best quarter seen in last 13 years)

How about earnings? In one of the slides Pacific Basin has shown how to model their earnings and used an example of

September 2021. The underlying earnings came out to around 90 million USD for September 2021. Based on my estimations, the earnings should be around 235 million USD for Q3. To put into retrospective, earnings in June 2021 came in at 53 million USD. Hence it is an improvement of 69%.

This means that assuming such numbers hold and do not improve, full year earnings should come in at 1.04 HKD. With 0.78 HKD of earnings coming in 2H. Do note that this is a very conservative estimate.

As as result the current price will indicate a PE of around 3.4. If the 2nd half earnings PE are used then it would be less than 2.3. Of course this would be a rather bullish estimate because usually the 1st half of the year is a traditionally weaker part of year for dry bulk.

Random Person might ask: So u talk so much cock liao. Can buy or not?

Broken Answer: Yea can buy, but can make money? i think chance of making money is there but risk is high lor where got so simple make money.

A more proper Answer: 2023 will be a new ball game for dry bulk with rules of lower emissions which means that speed of vessels will be slower. This will benefit newer vessels that emit lesser. There will also be a need to customize older ships or to replace them all together.

The supply of new-built dry bulk remains low when compared to the previous such peak of 2008. The covid problem and supply chain disruption remains strong. Winter is coming there will be increased usage of energy.

I believe rates of 2022 will be lower than 2021 but not much lower. Then in 2023, rates would likely sustain compared to 2022 due to the rules. If such theory applies then the PE is probably too cheap especially when considering that the average age of its fleets are 12 and 10. Which means that they can run for more years as average fleet duration is 20-25 years. Even if they are not being run, they have a resale value which has been increasing this year.

(Black Line refers to 10 years Handysize.)

(Price increased from around 7.63 at January 2021 to 15.43 in October 2021)

2nd Investing Thought (More Provoking)Sir, are you a troller, investor or an opportunist?

Recently someone sent me a link to attend a Uni-Asia Presentation held by Maybank on 4 October 2021.

(Ok sounds interesting, lets register and see what they say)

Unsurprisingly that Maybank had such connection as they were the ones who did the private placement back then in 2019 for Uni-Asia.

(Fun Fact: Investment is spelt as Investmet) I chanced upon a question asked by one of the participants. I did not manage to capture all questions asked by this person but he probably asked closed to 10 or even more questions.

From the way of the writings, he/her is probably from a group or a company or some clandestine alliance. As anyone know from zoom, you can register any name u would like from Donkey Kong to Mario Kart to Andy Lau hence the name does not really matter.

I took offense to the suggestion of share buy back up to 3% every 6 months. Well it is not a bad suggestion when first looked as it increases the share price due to the increased demand. However, i am unsure if you are a troller/investor or an opportunist.

As a troller you would probably want to troll the management whenever u have the opportunity to interact with them. Hence you would throw such a curve ball suggestion. However, such suggestions should be tabled during board meetings or during agms. I believe an info session is not the best way to show such question. What would other attendees think? Idk. It would be better if you have emailed the investor relations or the company this suggestion even if it is correct.

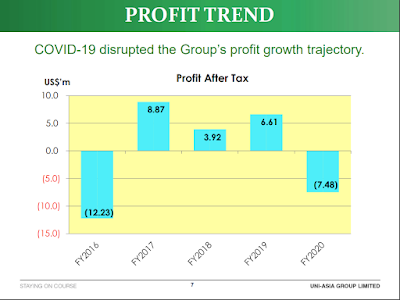

As an investor, i would want to see the company grow. Of course, share buyback is good, but for a company that has made only profit in 3 of its past 5 full FY, are we jumping the gun too quick with a buyback on the back of a decent 1st half result?

I would be more happy if the returns are in the form of dividends and the profits can be used to generate future growth as an investor. After all, if the company is really worth what it is worth, the value will be reflected in long term whether via capital gains or dividend distributions

(Company actually lost more money than made money in last 5 Full FY)

As an opportunist, you would usually want to seek for a catalyst. Unfortunately there has been no catalyst so far apart from a rosy business outlook for the company which is not a catalyst.

Therefore we need to create a catalyst so share price rise and a lot of people wanna rush in to buy then we can happily dump to the kumgongs as we have loaded plenty previously at lower prices.

All in all, i just feel that the suggestion has been tabled at the wrong place.

Lastly to end of on a more serious note, the average age of Uni-Asia Dry Bulks are 8.6 years.

Albeit a lesser operating scale compared to Pacific Basin, Pacific Basin with 13% Handysize ships in 20+ years and an average age of 12 managed an average of 24,350 charter rate in 3Q 2021. Hence as mentioned in 1 of my previous post, i would be disappointed if Uni-Asia did not hit at least 20k in 3Q 21.