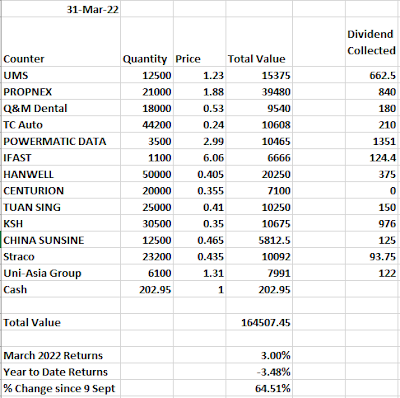

Its the end of the month again. Which means its time for the tallying.

Thursday 31 March 2022

(March 2022 Results) How i would invest in the singapore stock market if i had 100k of spare money

Thursday 17 March 2022

Quick Thoughts on HK Markets these few days

This month is probably the most thrilling month that investors in HKEX had for a couple of years.

The month started off at 22700 points, fresh from a 10% drop from February's peak.

Then it took 2 weeks to plunge to a low of 18235 points. That is around 19% drop in 10 trading days.

To put things in perspective, this low has far exceeded the 2020 covid lows of 21139 points and also beat the 2016 lows of 18278 points.

The reason for the sell down could be attributed to a lot of factors as everyone seem to have a version of their own for the crash.

Reasons included (but not limited to)

1) Ukraine crisis spillover effects as people claim that China Markets could be the next Russia Market due to China's stance in the conflict.

2) China speculated to cut rates and that is signifying a poor economy ahead

3) US's listing rules for China Companies listed in the US.

4) The infamous Alibaba bull analyst of JPMorgan downgrading Alibaba and followed by a huge list of China Companies listed in US being derated and sold off.

5) China Covid Cases surge, Lockdowns in Shenzhen and rumoured to be in other cities such as Shanghai

6) Feds Hike Rate Risk. Fears of a larger than expected increase and higher target interest rate announced.

7) Hong Kong Covid Situation getting out of hand.

All in all, the important question to ask is are the reasons affecting the business prospects of your company that is being sold down?

If yes, what are the risk and how big are they? For example China Covid Cases surge will result in tourism and restaurants related businesses to suffer. This is something tangible and can be assessed. For things that are unable to be assessed by most such as war involvement / delisting , then the easiest thing would be to ask yourself if you are ok with the risk involved and the likelihood of the risk happening.

If no is the answer then it would be better to sell them or not even invest in them and go back to boring stocks like DBS, UOB / OCBC.

For myself, i did not source for any new ideas during the 2 down days. Instead i calculated the amount i am still able to take out despite having <20% cash and decided to average on certain positions. Some are still in the red even after 2 days of epic recovery in the hang seng index.

Most importantly, it is critical to pay attention to fundamentals. Especially for smaller companies that are cash rich and have a decent/good/acceptable business with results to show for. Because when a recovery comes, they will be able to soak in the good news and go up even higher.

But what if market conditions continue to be bad? Then it would be good to add the criteria of dividend yield and would pay a good yield. This ensures that you are able to purchase the stock at a lower price and being compensated with the dividend yield.

Too good to be true? I will list down some companies that have such things happening.

1) Central China Management (HKEX: 9982)

This company operates in the china property environment as a project management company.

The company started the year at 1.50 and has dipped to 0.80 in the most recent lows.

On 15 March after trading hours, it has then released results which indicated full year earnings of around 30 HK cents, a final dividend of 9.90 HK cents. Total dividend for the financial year is 18.50 cents. This translated to a yield of 23% as of its lows and even at current price, it has a yield of 16%.

To top things off, it has net cash (Cash - Liabilities) of 54 cents HKD as of its latest result.

Are there any risk to the company? Of course there are inherent risk to each company, as such one has to do the work and research the company to investigate if the crash is more likely to be due to market conditions or fundamental change of the company. To find certainty in something is always difficult and the answer you would likely to get is probably which you then assess the chances of things happening.

Some times you are right, some times you are wrong.

2) Central China New Life (HKEX: 9983)

This company is related to the 1st example as both companies are related to Central China Property. It is the property service arm of Central China.

At its recent low, it has hit 3.18 (although it has hit 3.0x level intraday). From an investor point of view on 15 March who has not seen the results release on 16 March after trading hours, we were able to gather these few information.

1) Company has issued a positive profit announcement on 24 February stating that they will earn at least 45% more in 2021 compared to 2020. This translates to a profit of at least 638 million RMB or in terms of Earnings per share, it would be 62 HKD cents. Which mean that at current price of 4.36, it is a PE of 7 and at 3.18 it was a PE of 5.12

2) Company pays decent dividend. In 1H 2021 it paid 14.5 HKD cents from earnings of 26 HKD cents. This translates to a payout of 55%

In FY 2020, the company has paid out 24 HKD cents out of earnings of 47 HKD cents. This translates to a payout of 51%

3) In the 1H FY 2021 report, company had net cash of 90 HKD cents. If one wants to value it more riskily and assumes that its receivables can be fully used to pay off its liabilities, then it has 233 HKD cents.

Are there any risk related to the company? Definitely there are risks associated with the company that one would find after research into the industry and company. For example, there are risk with its receivables as a good chunk of it is related to Central China (its parent company). Also there are risk that they might not be able to put the cash to good use in acquisitions.

Despite all these risk, the company declared a dividend of 33.7 cents on 16 March (after trading hours). This meant that the yield at 15 March is 10.5%. Even at current prices the yield is 7.7%.

Conclusion

Opportunities to present themselves in selldowns. Picking good dividend paying stocks will allow one to be more sheltered from the sharper drop in price in the form of dividend payments.

Another important thing to ask would be how the news in the market affect the company's business prospects. Then self-assess and decide if adding such positions at a depressed market is worth it.

What's next then?

I would probably go through the list of companies that are still hovering around 52 week lows despite the up market these 2 days and see if they are dividend paying and have good business prospects. Then assess if these companies are worth taking the risk to invest in them. After all, if the company is still hovering at close to 52 weeks low despite probably one of the biggest 2 day increase in the last 6 years of the Hang Seng Index then there are possibly a few reasons.

1) Company's trading volume is low and is not liquid hence no one buys the stock even in up days. But unfortunately in down days some might have sold it to buy some other companies that have corrected even more.

2) Something wrong with the company

3) Recently IPO-ed companies. Usually the smaller caps have a downtrend over time.

Regardless, it is important to assess the company fundamentals.