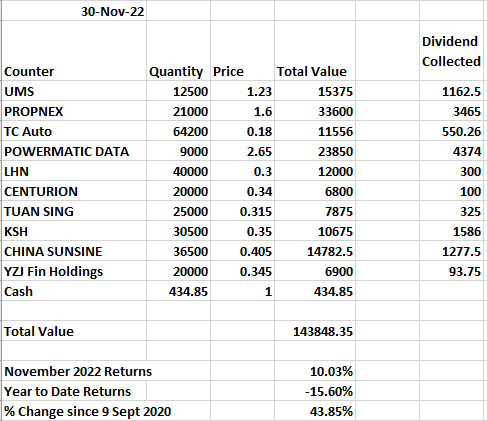

Main Returns driver would be Propnex and UMS. While the main laggard would be China Sunsine.

A lot of companies reported results or business updates in November

UMS - Solid Results even though the 2023 and 2024 recession and lower demand fears hingers in thoughts of many.

Powermatic Data - Solid Results, basically flattish in terms of main business but cash pile grows and the decision to not declare any dividend. Fortunately, to combat the long lead time and increase in components cost, the company has decided to increase prices since July 2022. It remains a very stable company in balance sheet perspective.

Propnex- 3Q Results was best quarter this year, although there are some other income factors that might not be as sticky, it is still a good sign to see that the stable base is there with the overhanging thoughts of increased financing cost in property due to interest rates as well as the housing cooling measures.

KSH- Gaobeidian starts to contribute slowly, have to assess based on full year results. Construction Portion Results improved as the gap (Construction Revenue - Construction Cost) has widened. Unfortunately the weakening of pounds and rmb probably ate into its profits and caused a large exchange loss. All in all, fundamentals remain solid, with a few JV and associates formed this year, this will likely start another cycle of participation in domestic prop development projects.

China Sunsine - Q3 2022 was an improvement against Q3 2021 but definitely lower than Q1 or Q2 2022. With falling raw material prices due to lack of demand as a result of covid restrictions, the timeframe has to be stretched longer and with the build up of production plants, the company is likely to be able to do well again when demand is back and it has higher production capacities.

LHN - Mixed Results. with a lot of revaluation left right centre. Co-Living remains a good growth trajectory. For the rest i can only sigh.

With that, waving goodbye for this month.

Business loans or personal loan within 2-3 working days with convenient rates. Apply today. Whatsapp +393481703911

ReplyDelete