Disclaimer: This stock pick has an estimated 99% chance of

losing money. Do read further if you are interested in the long post ahead and in losing money when you can put your money in the ssb/ t-bill instead.

Although if you have interest in seeing how i lose money, you can also continue to read further.

High Chance of losing money but here we go again trying

again at another attempt to build wealth. It might have been easier to just stay cash but I have promised

myself that I will keep going till the end of the year at least.

About the Company

Medialink Group is a company that does distribution of media content and brand licensing.

To be more precise, it distributes anime to various tv companies for them to broadcast and it does sell content and merchandise related to the brands that it distributes.

Some examples will be the company being the licensing agent for Sesame Street in Greater China Region and the sale of anime merchandise related to animes such as Jujutsu Kaisen: Zero. A popular anime that has grossed over 100 million in Japan.

In more recent times, the company has expanded its portfolio of brands and has ventured into various fields such as co-investments in flims.

About the CEO

As this is a people business, the person behind the company is definitely of utmost importance. Lovinia Chiu (趙小燕) is the founder of the company and has over 30 years of experience in the industry as she started in 1988 as a person in charge of sourcing overseas variety and drama shows.

The company is also not a new company as it has been started since 1994 by her after.

She has also been awarded the Outstanding Female Entrepreneur in Great Bay Area in 2020.

She has been in the Japan Market in 1990s, a crediting factor for her breakthrough at that time of point is her ability to consolidate the market information for the clients (Japan companies who have the flim rights). For example, she was able to let them know what are the time slots and how many companies are in various countries that the clients are able to market to.

About the Stock

Priced at $0.45, the company ipo-ed in 2019. The current share price is $0.134 as of October 2022. It has distributed a total of $0.0308. Therefore, the realised loss since IPO is around 64%. For a company that has maintained profitability and is debtless, this fall in share price is rather impressive that warrants a look at the company.

On a 5-year scale, the revenue of media content distribution

has decreased slightly from its 2018 levels. Nevertheless, it has bounced back from

2020 lows.

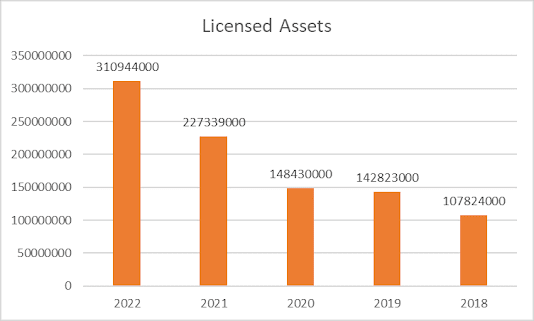

In terms of its brand licensing business, this is where things get interesting. The amount of revenue has increased by 436% since 2018.

From 2021 to 2022, it has increased by 80%.

In terms of segment profit, it is encouraging to see an increasing trend in its brand licensing business as it shows that there has been increased gross profit along with its revenue.

In terms of its ratios:

Current Ratio: 2.36

Quick Ratio: 1.41

Liabilities to Equity Ratio: 0.63

Liabilities to Asset Ratio: 0.39

Bank Borrowings: 0

PE Ratio: 6.05

PB Ratio: 0.48

Annual Report Message

Interestingly enough, for the past 3 years, the management has always started the chairman’s statement with a Chinese Phrase.

Annual Report Year Message

2022 機遇在手 盡展所長

2021 乘風破浪 勵志前行

2020 毋忘初衷,方得始終

If my level of understanding of Chinese is correct, 2022 sounds the most positive. Which is another reason for optimism

Decision to Buy and Probably Lose Money

-Management knows what they are doing, the founder is experienced in the field and has good business connections in this aspect

-Brand Licensing Business expanding in profit and revenue. With a record high licensed assets under the company, I anticipate the segment to either do well or go bust with a high amount of write-offs

-Walking out of Covid effect, with comic fairs being held in various places such as Taiwan and Hong Kong, there are more increased opportunities for spending in the merchandise of various areas.

-Management has guided previously that there will be double digit growth. Adding to the experience and honesty of the management in some interviews, the price remains cheap for an unique distributor of film and anime IP rights.

Key Risk

-Bad economy leading to a lack of demand for movie and anime films

-Overinvestment in the wrong IPs leading to huge write offs

-Sudden Japan Anime Prata Flipping. For example, Japan firing off a missile at another country and leading to worldwide boycott of Japan products or films.

-No reasons needed, markets are in a decline due to higher risk free rates and stocks will fall if they do not perform against the rising tide of interest rates

No comments:

Post a Comment