Following recent social media postings on Singpost, the company has been in the eyes of some retail investors.

From some of the comments i read, most would stay away from Singpost.

However, is that really the case?

I decided to take a look at it to determine if it would be a buy at current price of 0.62 as of 19 August 2022.

For Disclaimers, i used to owe some shares of Singpost as my 4th or 5th stock i purchased back in 2015 at around 1.7 and i sold it at 1.3 in 2017. Since then i have not really looked at the company closely.

Pros of Singpost

1) Internal Promotion of CEO. Following a long history whereby we had Ceos that did not really do well since 2015, the company has finally turned to promoting one of their own and not parachuting in anymore. They have promoted a CEO from the Postal Services Business to be the Group's CEO.

2) Strong Shareholder Backing. Its major shareholders include Singtel and Alibaba. With Singtel as a shareholder, it can be said that the company should be able to raise finances for a considerable acquisition should such chances appear.

3) Unreplaceable Moat. For the longest period, Singpost has been in charge of putting the letters and small parcels into the letter box of various households. While we used to get some flyers but in recent times these are getting far and few as the top of the letter boxes are being locked and as such its the Singpost man that has the access to the letter boxes. As such, it is very unlikely that anyone will come in and replace Singpost in doing these postal businesses.

Unfortunately, that's all the good things i can probably think of. Moving to the cons

Cons of Singpost

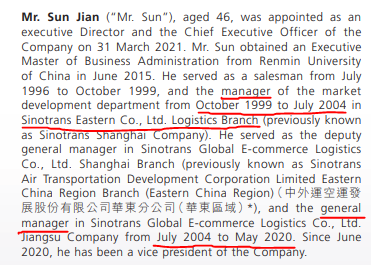

1) CEO has been in company for 2+ years. The promoted CEO (Mr Phang Heng Wee Vincent) has been in the company since April 2019 and his first position is already the CEO of the Postal Services. This meant that its not like he had worked up from the grounds or had a considerable amount of time being in the company to understand the processes from the bottom up etc.

To add on, he has a Masters in Aeronautics and Post Graduate Diploma in Flight Test Engineering as well as Advanced Management Program from Harvard. While the management program would definitely help him in his leadership abilities, i am not sure how aeronautics and flight test engineering would be much help to a logistics company.

To quote an example , YTO Express International 's CEO has over 20 years of experience in logstics field and even so, the market cap of the company is only around 900 million HKD compared to 1.4 billion SGD market cap of Singpost.

As such, i would have ideally preferred someone who has either worked at Singpost for a considerable amount of time or has been in the similar industry for a long amount of time.

The appointment of a leadership that has experience in other fields would only make sense if Singpost would like to diversify out of its current businesses.

2) Poor Performance of Post and Parcel Segment

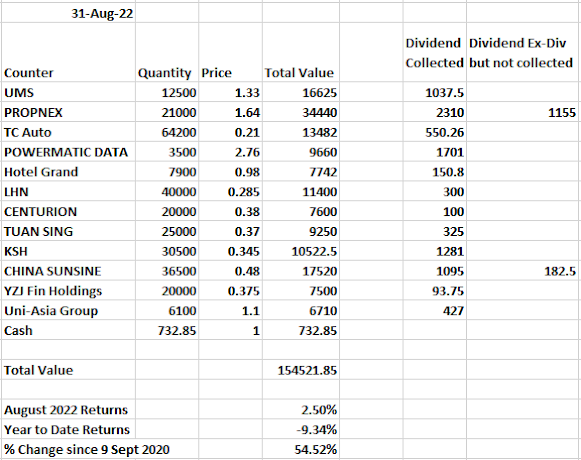

Ever since joining in April 2019, the CEO might have faced many challenges such as a declining market as well as Covid. However, the results are for all to see as operating profit continues to decline.

|

Time Frame

|

Revenue of

Postal

|

Operating

Profit of Postal

|

|

2021 April to

2022 March

|

622,334,000

|

24,851,000

|

|

2020 April to

2021 March

|

742,839,000

|

43,502,000

|

|

2019 April to

2020 March (Vincent Joins in 2019 April)

|

763,079,000

|

127,450,000

|

|

2018 April to

2019 March

|

764,751,000

|

165,864,000

|

|

2017 April to

2018 March

|

625,900,000

|

144,627,000

|

At this rate, we might see the postal segment being unprofitable by 2024 or 2025. At that point of time are we considering spinning it off to be a non-profit entity like one of the recently delisted company?

While i admit that times are different and the amount of things that goes by mail these days are getting lesser and lesser as folks go cashless and more things are available on the web for one to check. E.g CDP Statements, Brokerage Statements, Bank Account Statements etc, my understanding would be that the business is quite a human intensive business as last mile delivery involves a high amount of labour. As such, it should be alright to scale it down if volumes are down and use more technology in sorting and planning of deliveries to achieve cost efficiency.

3) Poor Record of Acquisitions

Probably one of the biggest weakness is that in trying to expand its revenue stream, it has made some bad acquisitions. In 2015 it acquired Jagged Peak and Tradeglobal which both went into Chapter 11 (Bankruptcy Proceedings) a few years later. Both of them cost around $190 million USD in total and its roughly 15% of current market cap.

Fast forwarding to present, it has acquired Freight Management Holdings. Once again, it has recorded a goodwill of 181 million SGD on its balance sheet.

While the company has performed well for FY 2020 (PBT 20.1 million) and FY 2021 (PBT 25.8 million), it seems to have subsided in performance as it recorded 8.85 million profit after tax for its most recent financial year. This might start to show cracks in its acquisition which might result in further goodwill impairment down the road

(20.1 mil AUD PBT in July 19 to June 2020, 25.8 mil PBT in July 2020 to June 2021,

8.85 mil SGD Profit April 2021 to March 2022)

4) Failed to improve profits of the company

Back in 2003 when it first listed, Singpost recorded 380.9 million in Revenue and 101.3 million in net profit in FY 2002.

Fast Forward to 2022, it has recorded 1404.6 million in Revenue but 47 million in net profit in FY 2021.

As such, if we look at it from a profit point of view, it seems to have taken many steps back and if we factor in inflation in the analysis, it seems to be doing much worst now.

ConclusionThere is no denying that the postal business is declining even though e-commerce is growing in the domestic postal business as Letters and Printed Paper continue to decline.

Profitability on most fronts are likely to be threatened as the margins for e-commerce is likely to be lower than traditional mail while its logistics segment's acquisitions has shown some signs of poor recent results. Also, the company has already shown poorer 1Q FY 2022

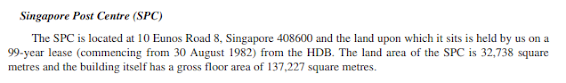

Having said that, the company still has some real deep value as the Singpost building is a deep value that will only be realized should the company decide to relocate its postal business or do away with it.

With a GFA of 137,227 SQM and assessing that Paya Lebar Square Offices has a Price Per SQM of $19,302(From Low Keng Huat Annual Report) , the valuation of the Singpost building would be around 2.6 billion . However, as it has only around 59 years left, it is likely to have a lower valuation.

To put it simply, to buy it for value play, it does not make sense as it is unlikely currently that Singpost would vacate the building.

To buy it for rental play, the Singpost building by itself is not attractive as its profits is around 52 million or 1.9 cents earnings per share per year.

To buy it for growth, there has to be a turn around in profits first which would likely to be driven by logistics or future acquisitions. Unfortunately, profits have been on a downtrend.

To buy it for strong leadership, i have not seen any outstanding points that suggest that this guy can be the next Jeff Bezos , Yu Huijiao (YTO Express CEO) or Wang Wei ( Founder of SF Express)

With that, i would not be considering purchasing Singpost at its current price.