Recently a thought came to my head, i wondered if the IPOs on SGX might have been getting worst or even underwater. I am not sure but when i see headlines of Digital Core Reit, Manulife US Reit , it gives me this impression

As such, i decided to as and when i feel like it, review some of the SGX Stocks that Ipo-ed in the past years.

2021 is likely a good year to start. The company would likely released its FY 2022 results being in a more 'clean slate' due to lack of IPO Fees.

The first company that came to my mind was Econ Healthcare (SGX: EHG)

Basic Info

Business Model: Operation of Nursing Homes / Elderly Aged Homes

IPO Price and Date: 28 Cents ( 19 April 2021)

Current Price and Dividends Declared so far: 19 Cents and 1.2 cents

Total Loss = 27.85% in close to 2 years.

Implied PE = 14.39

BV = 1.28

Financials

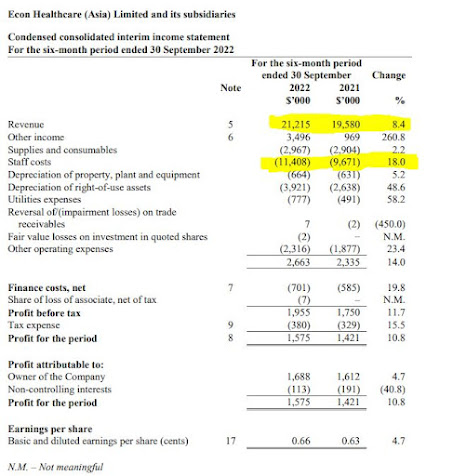

On 1 look, it seems like a good company for a staff to work in, as the increase in staff cost is the same amount as revenue increase. But we would have to factor the increase in subsidies from government and then all in all it looks ok.

Unfortunately. a likely one-off other operating expense due to their new Henderson Nursing Home and a slight increase in utilities as well as depreciation expense meant that profit only grew by 10.8%.

With overall occupancy at 77.9%, there is definitely more room for revenue to grow? Lets find out.

Revenue = 21.215 million.

SG Revenue & Occupancy Rate: 18.39 million & 96+%

Msia Revenue & Occupancy Rate 2.609 million & 77.5%

China Revenue & Occupancy Rate 0.212 million & 77%

Hence at full revenue, 22.80 million is possible. 26% revenue growth. Not great at all.

Looking at tariffs has stabilized, the company just have to be more proactive in growing its occupancy rate and profitability in Msia and China. Then it is likely to have a better 2h compared to 1h. Furthermore, its cash flow is supposed to be better as most of the gains in revenue and other income is eradicated by depreciations as well.

Looking on a more long term scale, it has a 732 bed in Sg upcoming in 2025 while a 280 bed in China in 2H 2023. While i am excited over this 732 bed in SG in 2025 as this is inline with government policy to add 5000 bed from 2020 to 2025. It also represents a potential revenue increase of over 60% for SG Revenue, its strongest source of revenue and profitability.

Red Flags

1) Company has been involved in stock scam scandal before, putting in money into a pump and dump hk scheme stock and following which have been duped as the share has rapidly decreased. If an investor like me could tell that it had no earnings and no dividends record, i am pretty sure the reason

Though i do admire the courage as the company continues to go on with its core competencies.

2) Nice Mistake but lets pay more remunerations.

It baffles me how the founder is paying himself more for making an investment mistake which caused the company to be barely profitable and dividend to be lower than what one might had expected.

This just reinforced my initial thoughts that the quality of SG IPOs in recent years might be going down hill.

No comments:

Post a Comment