Introduction (Cautionary Comments)

My recent records on SGX Stocks has been disaster. So much so that i actually contemplated if i should ever buy into this counter that i have researched about. After some consideration, perhaps blinded by the need to overdrive and greed to achieve my targets, i have decided to throw the dice and gamble again by going back into sgx stocks. I can only do as much research the rest will have to leave it to fate and luck to decide my wealth.

|

Prior SGX

Stocks Purchase

|

Profit / Loss

|

|

HG Metal

|

Loss (-7%)

|

|

Hotel Grand

|

Loss (-0.51%)

|

|

Samudera Shipping

|

Profit but Current Price higher than Sale Price

|

|

SUTL

Enterprise

|

Loss (-0.51%)

|

Therefore it is very important to consider the above before actually reading further.

Company Introduction and Thesis

The company that i will be sharing today is Ossia International (SGX: O08).

The Thesis for the company is: Golden Hour Arrives but Storms are ahead. Is current price mispricing?

Company Business Segments

The company can be broken into 2 portions. The first being its stake in Harvey Norman Singapore and Malaysia while the second will be its retail operations in Taiwan.

The first segment as the mentioned earlier will be retail operations of Harvey Norman Singapore and Malaysia which has online sales as well as brick and mortar sales. Pretty Straightforward.

The second segment being its retail operations in Taiwan. The company distributes Columbia , Kangol, Tumi, True Religion and Sorel products. They can operate as standalone stores found in Shopping Outlets such as Taoyuan , Retail Spaces found in Shopping Malls such as SOGO or via their own website store or web stores on PChome.

(An example of the store layout in a taiwan departmental store)

Thesis for Buying1) Solid Singapore and Malaysia Operations.

Contrary to popular beliefs that brick and mortar will rip due to ecommerce and all, harvey norman's Singapore and Malaysia Operations have shown a good growth in profitability across a 5 years trend.

Profits rise from 25 million in 2018 to 45 million in 2022. Similarly, Revenue has rise from 489 million to 637.96 million.

2) Improving Operations in Taiwan.Taiwan's operations have always been stronger in the 2nd half (Sep to March). This is largely due to its brands such as Columbia selling much better when it is winter season compared to summer season. Taiwan experiences colder temperatures from Sep to March, with temperatures falling to 11 or 12 on some days.

With the brands including travel theme such as Tumi and Columbia (buying of winter clothes to travel), this is definitely a play on travel resuming in Taiwan. At the same time, Kangol has been a relatively well known brand worldwide outside of Singapore. I am always happy when i see someone wearing Kangol in South Korea or Taiwan.

As such, i do expect that the revenue will be stronger this 2H and gross profit will follow as well.

While i have not found any clear indication that revenue will be stronger(if i had the time i probably would want to monitor things at 台中 on a weekend where i am finally free), a couple of things i noticed that reinforced some beliefs in the company are as follows.

(Level of Relevance: High. Article in October 2022 saying that Columbia Jackets are hot sellers and record double digit increases in Climbing brand jackets. Due to its ability to be multi purpose of waterproof and windproof.)

(Level of Relevance:

Low. Munxin Revenue from Sept 2022 to March 2023. Munxin is also one of the listed taiwan companies that has spaces in retail mall operations. While there are some overlapping similarities, it is more of a fashion/sports distributor. However, i use it as a gauge of how retail operations are doing in Taiwan. The

double digit increase is encouraging to me but is more of a good to know.)

(Level of Relevance:

Low. Columbia LAAP Distributor Data. Good to know its up low 80% but knowing that Taiwan is a small country and the revenue for a full year is not even 30 million, a quarter of revenue is a small part of LAAP.)

(Level of Relevance: Mid-Low. Samsonite Taiwan Revenue in 2022. As Ossia only has Tumi segment, which is under Samsonite (which has multiple brands such as Samsonite itself), this is good to know but unlikely to provide much analysis as Tumi might be a small portion only. In fact pre-covid, Taiwan Revenue was 20+ million USD, which is larger than Ossia Taiwan Revenue. This is why the data is Mid-Low)

(Level of Relevance: Mid-Low. Taiwan Operations hiring on a job site. If anything about this website is accurate, then the hiring of 17 people when total workers is estimated to be 180 which is close to 10% shows healthy signs)

(Level of Relevance:

Mid. Kangol Taiwan Website Traffic Data. Good to know that more people in taiwan are surfing the site which shows its increasing presence in taiwan. As it is possible to purchase from the site as well, this could mean more profit.)

(Level of Relevance:

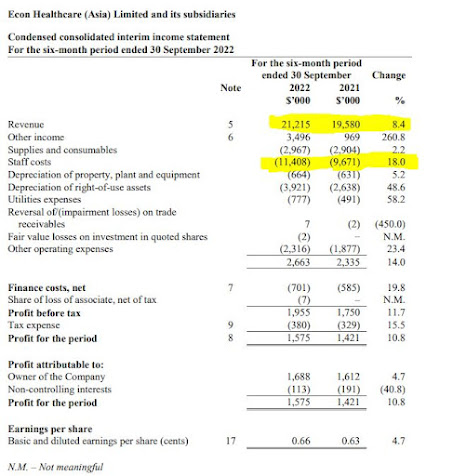

High. This is the 6 months profit of Harvey Norman Singapore and Malaysia Operations. While it is good to see a 30.8% growth, it is good to see that the AUD weakening was not a strong reason to be contributing to profits.)

(Level of Relevance: Very High. 2Q 23 refers to October 2022 to December 2022. In terms of total sales, Singapore and Malaysia has recorded a 6.8% and 6.2% increase in retail's usually strongest quarter. This increase is in constant local currencies which makes the comparison more compelling. In fact it was one of the decisions that compelled me to press the buy button when i already dun have much ammunitions remaining.)

George Goh is the Group Executive Chairman and the Goh Brothers own more than 50% of the company. As George Goh is recently more into updating his information and social profile, it is much easier to find more information about him and what he does. With more increased public exposure as well as the increased sharing of the Harvey Norman Story in recent months, i would believe that things are looking up or at least looking decent.

(George having a board meeting in Malaysia Harvey Norman)

More information about George Goh

(Interview with Zaobao. Published 12 February 2023)

One of the critical comments about my investing style is that i am someone that does not look a longer term horizon and paint a story and analysis about the company.

My view towards that is that i do not have such visionary sense and i am more concerned about how much % i can make from a company in the short term compared to a story that might go wrong some how.

Imagine painting a story of a certain property company in china making its recovery in 2026 and 2027 because it has sufficient balance sheet and diversification as well as the know-how and all. Even if the story is compelling, it is hard to estimate the gains made in 2026 as well as the opportunity cost might be too huge. To begin with, story telling is good for earning a job but rather hard for the portfolio especially when i just want to overdrive until i bang my head.

Back to Harvey Norman Malaysia, it currently has 28 stores. At Harvey Norman AGM, it has been announced that they are looking to increase the number of stores to 80 stores by 2028. 6 years. 52 stores increase.

This is a roughly 10.6% increase number of stores per year. Of course to satisfy some people we need to start painting a story and a thesis (as much as i don't like to do it).

First off, we need to find out if increase in number of stores has been a success at Harvey Norman Malaysia Operations. From the graphs below, we can see that revenue has increased as number of stores increase. In the initial years, when stores increased from 18 to 23, there was a impact on store per revenue but it has recovered in recent years which is expected as it takes time to ramp up revenue at a store and dependent on when a store is opened it will affect revenue as well. Taking a bad case of 0.9 million per store, we are looking at 720 million revenue. Which means profits could close to triple.

Of course, as good as this story sounds, it is good to have an overall direction but a lot of tracking is needed. After all, they have announced this back in 2019 but Covid delayed a lot of what they wanted to do.

Lastly, it is also worth noting that i called it the golden hour before the storms. In fact, the storms are things that everyone are familar with. Inflation increasing cost of living, Increased Housing Prices in Singapore, Negative Economic Growth Fears as well as Unemployment Fears, High Interest Rates. These are likely to affect consumer sentiments of retail although if you ask me truthfully, i would say Harvey Norman has already performed better than its peers (more on that later). Also, it has done well in the past 5 years especially recovered from the Covid Lows.

In fact, in January 2023, sales are lower. While it is unsure that how much of this is due to CNY effect, Malaysia Retail Sales remain strong. Personally i think that Jan to March is less of an important quarter compared to October to December hence it is likely to play a lower role.

Conclusion

We have a company that trades at a PE of less than 5 based on Half Year Results and Book Value of 0.65. Profit of Harvey Norman Singapore and Malaysia Segment for July 2022 to Dec 2022 has been higher than Jan 2022 to June 2022. Also, sales growth is seen from Oct 22 to Dec 22 (which is not reflected in Ossia Half Year Results which ends at Sep 22).

In the Taiwan Segment, it has been improving year on year and with cold weather in Taiwan and the resumption of travel, i expect things to be better as well and record higher profits.

Last but not least, the executive chairman is someone who has a decent profile and has increased public exposure in recent times.

I wish there was more liquidity in the stock and i have more ammunitions to add into it.

Peer Comparison

Senheng is a eletrical retailer in Malaysia. Also one of Harvey Norman's Malaysia Competitor.

It recorded a

decrease in revenue of close to 3% quarter on quarter. However, Harvey Norman has recorded a

increase in revenue of 6.2%.