Time for changes?

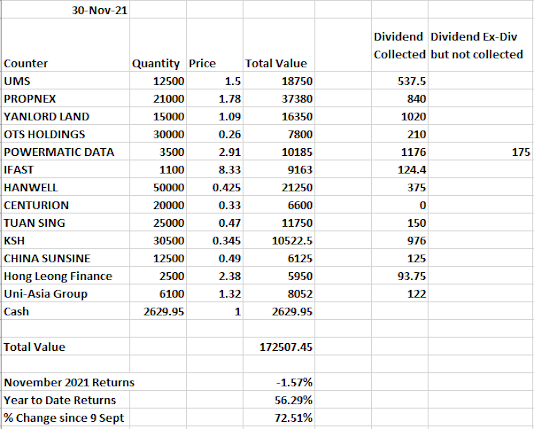

The end of the month has presented an unique opportunity as the new variant seems to have split stocks apart.

We are back to the general market downturn along with the Covid beneficiaries coming back again.

However, i have decided to not make any changes as i believe that the mid-long term investing still holds for the portfolio. That is after reviewing the results of companies in portfolio.

TC Auto is a company i have considered to switch some shares into this newly listed company. However i have given myself another month to think about it and to think on a broader scale for 2022.

Results of companies.

KSH (1H FY 2022) - Results Acceptable, projects still unprofitable but mitigated by rental income, developmental profit recognition. Gaobeidian project remains the long term value to be unlocked.

Powermatic Data - Interim Dividend a pleasant surprise. Results remain stable.

Propnex - Q3 result seems to have slowed a little vs Q1 and Q2 but this year remains a strong year and with covid backdrop, properties remain something that 1 can look to upgrade on and demand in theory is still there.

UMS - i think results are ok, semi-conductor story still plays out.

No comments:

Post a Comment