Disclaimer: This post is not investing related but just some of my views towards life in general.

Just need to let off some thoughts that occurred to me for some time.

Since young, i probably make decisions that is somewhat the minority or decisions that probably only i would make. Well everyone has a lot of choices and most might make a certain decision, i end up making the 'less walked path'

Cite a few examples

I used to play trading cards and i would usually enter tournaments playing 'Anti-meta' decks which is the minority

When people were supporting various groups in Kpop back when i was way younger say 2013, i would be supporting the lesser known groups.

Probably that is attributed to me not having much of common interest with various groups of people.

If i known the person through investing, then all is fine as usually the chit chat will be about Investing.

However, for my personal small circle of friends that i know not via investing, i don't have much to chit chat about as my main interest is in K-Pop.

Which is why i was glad i had some chit chat with a few solo travelers that were Singaporean as well during my trip to Korea. It was the most i had chat about K-Pop for a very long time.

I have a few personal friends who are into K-Pop but unfortunately they are only into the 'meta' as usual. Not gonna name them but yea its the standard few that has color in the name or numbers or they are from the more famous companies. Also with Covid, they have kinda developed less interest for K-Pop in general as well as due to lack of events in Singapore. As such, sometimes talking to them about K-Pop is not really interesting as well as they like to ask 'Who you went to watch?' then i replied them the idol name they just went oh.

Yup that classical 'Oh' i have heard too many times which stands for oh ok thanks for info but i dun want to know anything more cause i dunno the person.

Well nothing wrong with supporting the lesser known groups but as mentioned earlier 'the path less travelled' and 'divergence'

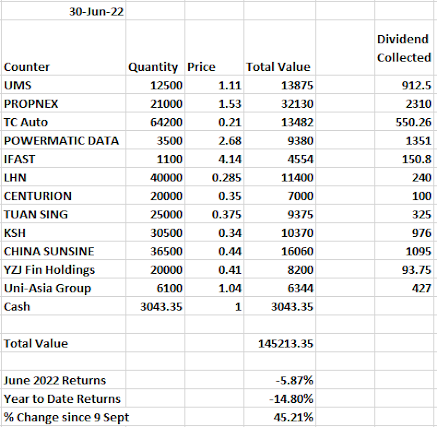

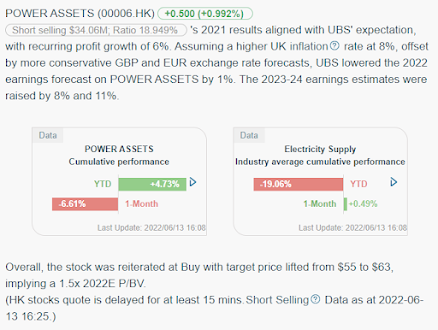

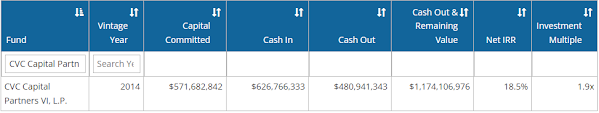

This has probably extended into my investing as well. I tend to do it alone (introverted me in nature) also the stocks that i probably pick and the reasoning behind it tends to be very not common either. Its not something that you would see in most people's portfolios. In fact its weird if they are in many people's portfolios.

To me i don't see anything wrong with Divergence, its just a way of life and the most important thing is to be happy with one's life via one actions.

In terms of travelling, my previous 3 trips by air has been solo trips. I have gotten used to travelling alone that i do not really like to travel with others. To cite an example, my friend was actually discussing the itinerary with his other friends for a trip to JB 2 weeks ahead of time.

My first instinct was that its quite fortunate that i am not travelling along because i don't like to plan and stick to a plan. In fact i had travelled with my friend b4 and i ended up not sticking to the plan and sometimes things go sour. I prefer to not be the sour grapes to anyone's plans and therefore it would be better that i travel alone and probably if that person wants to travel along he can travel by his own plans and we can have some meals but not stick together for most of the trip. Of course, my introvert nature also plays a part in travelling.

Of course we can never not mention the Singapore Dream which is something that is happening to most of my peers. I feel truly happy for them as they have made decisions and are edging towards various milestones that they have chosen to achieve.

Unfortunately, that is not something i have in mind currently and unlikely any time soon although the door is not completely shut but its probably less than 1% open.

I feel that by pursuing the Singapore Dream, i probably have to sacrifice a lot of things that i want to do in life and also it takes a lot of commitment and effort. If i am not committed then its better off not doing it or giving a lousy effort at it as it affects all various stakeholders involved.

Furthermore, i have a few friends that are way better quality than me in terms of physical, character, career, prospects, commitment etc. I do feel that its weird they are still single as they are on the lookout for a partner and i think they deserve to get attached soon and i would feel happy for them.

With that said, i think divergence is probably a big part of me, just that i happen to divert at a lot of decisions / interests and hobbies. I probably will feel happier if i can find like-minded groups at various things individually as well as listen to myself on what i really want and doing it.

Story Time

Just want to say a simple story using some pictures.

(Continued to wave as well)

If anything i learn from this is that, sometimes things just don't go your way but you will still have to embrace the small obstacles and overcome it. Also sometimes luck is just bad to you, there is no reason needed (just like the rain that happened only for this group and for others there was no rain). Just have to embrace it and still do your best.

Just like idols training thousands of hours for a few minutes on the stage ( its like one's knowledge, experience, emotions and thought process in investing), has to be built up with time as well so that you can overcome obstacles (in this case its rain / slippery floor/ obstructed vision due to rain) and still put up a good portfolio performance(in this case its good stage performance).

While i am not sure if this performance would catch the eye of a few and gain them some reputation, i have begun to listen to their songs more often because I liked their professionalism and performance.

You can catch the performance that day via this youtube link (https://www.youtube.com/watch?v=jIAIUnX2zOs)