By now i guess everyone should be familiar with Astrea Bonds already. Basically it is a portfolio of Private Equity Funds and it is broken up into different tranche where the top tranche has the lowest interest rates but is the safest among the different tranche.

Interestingly, this time around, retailers have 2 choices to choose from.

Class A-1: 4.125% (S$ 280 million)

Class B: 6% (US $ 100 million or around SGD 140 million)

Reasons to Press

1) Current Astrea Bonds trading at a premium. The Yield to Maturity of current Astrea bonds are trading at below 3.6%. What this mean is that there is a very good chance that the new issue will open above water and it will allow for retailers a chance to make a quick profit.

Astrea IV started with 1098 million in 31 March 2018 and at 30 November 2021 it has 718 million left having distributed 826 millions. Had there been no distributions, it is an increase of 40% in 3.5 years.

Annualized gain of around 10% is impressive. Also it has earned enough to cover the 27m of interest payments each year.

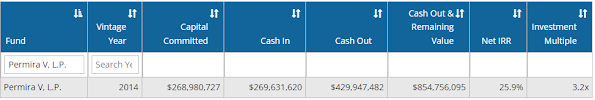

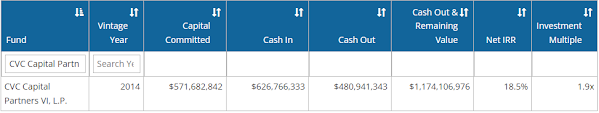

3) Astrea 7's old funds did well as well1 thing about PE is that we are concerned with performances of funds that are coming to a tail end of their life span of 10 years. With 2 funds having started in 2014, it is important to know their performance.

1 such fund is Permira V and its record of 25.9% net IRR isn't bad at all.

Reasons to not Press

1) Tech Valuations have fallen and Recession is looming? Amidst the cloudy circumstances that is circling, there is some concerns given that Information Technology is 33.9% of the portfolio. There might be some earnings concern.

If a market downturn continues till like 2027-2028, this will affect more than 50% of the funds which are looking to exit their investments and they might have to exit at below NAV due to depressed valuations due to down turn.

2) Much more attractive options? A question when we deploy cash is to ask if there are attractive things out there. The markets have fallen quite a bit this year. S&P 500 for instance is down close to 18.5% as of 19 May. Hang Seng Index has fell by close to 30% over 1 year period. As such, some markets might appear 'cheap' and the opportunity cost to invest in these markets might be more attractive.

3) Interest Rate Hikes. 2 ways to look at this. We know the rate hike is coming but the amount of increase and number of times is not certain yet. If rates keep increasing, we will demand a higher return and this might drive the astrea bond to below par value which will deter some who might want to divest it to address their own needs.

Another way to look at it is that since 80% of the funds are Buyouts, they are very likely to be leveraged companies and the interest rate hike might affect them negatively. This is something once again that we can only see when the half year results comes out and the NAV is recording fair value losses.

Conclusion

Its a press for myself. Though i have not decided on the amount and whether i want to hold it for long term or short term.

Barring a sudden rate hike by the Feds this month again due to black swan events, I do not see the bond opening underwater.

Of course i am wary of recessions and all but i believe that there should be enough warning signs to get out should the signs show that the A1 tranche will be affected. The pros outweigh the cons.

Lastly, should we apply for the Class B Tranche? Taking a look at the chart, the BBB Corporate 10 years is 4.908%. As such, the 6% that is on offer seems to be an attractive choice as there are many different companies involved (982 invested as of Sept 2021). This should reduce the risk due to diversification.

Key Comparisons for Thoughts

No comments:

Post a Comment