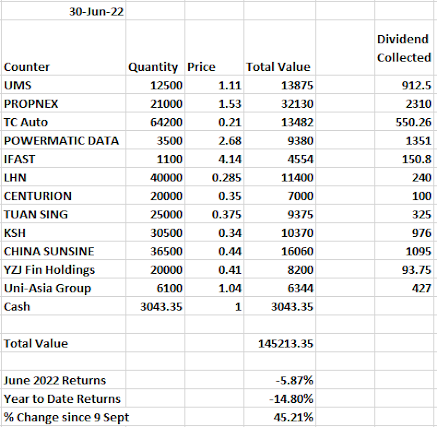

The STI has declined by around 4% in June. I am somewhat surprised that certain counters continued to decline in June.

I have to apologize because i was too occupied with planning for my Korea trip and the trip itself that i have neglected some parts of monitoring of the portfolio.

On a more serious note, i do not have any urgent concerns with regards to the holdings.

Propnex - Property Sales remain mixed. New sales is up in May while resale hdb volume is down 5% from April. Increase in million dollar resale flats from 22 in April to 30 in May while resale prices rise for 23rd month straight.

The following months should be tougher with interest rate backdrop.

Powermatic Data - Results was ok as previously mentioned, with huge cash pile, i would consider adding this should it come down as it will be able to benefit from the interest rate increase.

TC Auto - Reopening should benefit the company, BMW's China Car sales in May 2022 have recovered from April lows and has matched May 2021.

Uni-Asia Group - Mixed news again. Dry bulk has came down but maintains at profitable levels. Some good news from Hong Kong side as the quarantine has been cut and there has been increase in interest in its HK Office Property. For e.g one of the projects sold out the top 2 floors to a HK Company.

Of course, the usual playbook of hospitality and financial institutions is on the cards should a switch of companies be required. But i do not see any need to make changes as of now.

Once again, i apologize for the really bad results in the first 6 months of 2022. I will work towards reviewing the portfolio and hopefully it generates better results

No comments:

Post a Comment