As the title goes, this will very likely be the last new stock purchase of 2023 unless something interesting pops up in the final weeks of December. While it is unlikely, sometimes never say never.

The company that I newly initiated is San Miguel Brewery HK (Hkex:0236). Like its name (SMB HK) suggest, it is a beer producer. I will address it in short form SMHK / SMBHK in the post ahead.

Lets take a look at some of its latest basic financials (taking into account trading price of 0.77 HKD as of 14 December 2023)Trailing PE: 3.70

Price to Book Value: 0.46

Cash Cover Current and Non-Current Liabilities? = Yes

9 cents of free cash after Cash-Liabilities.

Investment Properties Stated at Cost? = Yes. At fair value it is around 396 million more than book value. This translates to around 1.06 HKD of 'hidden' value.

Of course based on above is this a buy? I think the zzxbzz of pre-covid might have just jumped in to take a small stake but i guess with discount rates so high now and opportunity cost getting even higher, there is really a need to take a closer look at the earnings side.

Earnings Thesis: Record 1H 2023 but really unlikely (90% chance) to repeat it in 2H 2023.

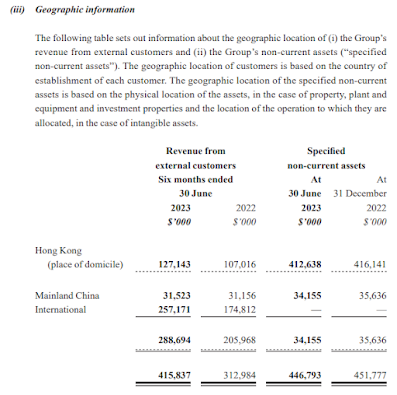

San Miguel HK had an earnings blowout of 0.13 HKD in 1H 2023. On closer look at its results, we can infer that the results are as a result of export growth.

Why did i say that this is not possible to be replicated? This is due to the export 'Cap' that the company has with San Miguel Group which exports San Miguel Beer to the international marketAs at 30 June 2023, the connected amount is 251 million. Which is close to 98% of the International Sales of the Company.Unfortunately, this cap is at 407 million. Which means that at best, the company can only sell another 155 million to San Miguel Group under this arrangement. While SMB HK does sell some amount to international that is not connected, it remains to be seen if they can expand this portion in 2H 2023. Should it be unable to do so, then 2H 2023 will unlikely exceed 1H 2023.

However, the guided amount of 2024 and 2025 is around 17% more than the previous year which is encouraging growth to be seen should it be delivered. Any potential upside will come from the change of terms of this transaction.

However, if we look at the company's financials in another angle (From the parent company)

The wording for 3Q 2023 does not sound bad. However, we have to be mindful that last year was a low base and this commentary is for 9 months 2023 altogether instead of just 3rd Quarter.

This is where we need to try to do some deep dive to find out if we can find any correlation for the earnings. After some many nights of digging and sleeping on it and then digging again.

There are 2 methods that we can use to try to guess its earnings.

1) The good old NCI Method.

In the 2022 Annual Report, there are 5 companies that are part of the NCI.

They are PTD (Indonesia), HK (San Miguel HK), SMBTL, BPI and SMHTL (Thailand)

The 2022 net income distribution among themselves are 71.54%, 16.05%, 0%, 2.64%, 9.75%

However, the NCI representation is weird and haywire which makes any counting not accurate

To make things even harder to count, the SMBTL has a mind boggling financial results in 2021/2022. At 2021, it has positive carrying interest for NCI and Negative Equity of P2022. In 2022, despite turning in net income positive, comprehensive income positive and no dividends declared, equity fell to negative P2039 and carrying amount for NCI is negative.

As such, using NCI is not a good option. For example, NCI decreased from 420 in 2021 to 275 in 2022 but SMBHK net income to NCI increased from 48 to 79 in the same time frame.

2) Estimating from International Beer Operations Method.

International Beer Operations consist of 5 companies. PTD, San Miguel HK, San Miguel Exports, Other 2 companies (small hence not mentioned)

In 2022, San Miguel HK contributed 10% of profits to international operations

PT. DELTA DJAKARTA TBK (PTD), another arm of San Miguel which does the Indonesia Operations, contributed 38.19%. Other 2 companies contributed 8% and 4% while the rest is exports. Which is weird as the 4 companies mentioned above made 84% of international revenue while only explaining 62% of profits.

Bearing the above in mind, we plotted PTD's profit as a % of international operations as well as SMBHK. We see a trend that is very obvious in 1H 2023 is that the increase in SMHK Profits has led to increased Int Ops Net Income weightage and reduced weightage of PTD's International Ops Weightage.

As PTD continue to contribute around 22.96% in 3Q 2023, we can guess that SMHK would not outperform 1H 2023 results when divided by 2 but likely fall around the range of 10-15% worst off.

That to me isn't bad at all.

Of course this method has its drawbacks as there could be other factors which affect the Int Ops Net Income and weightage. Also, when SMHK increased profit, the increase is not exactly the same as the increase in Int Ops Net Income.

Other News / Factors that might play a part in the analysis

1) HK Alcohol and Tobacco Retail Sale Statistics

While there is no strong correlation between that and the sales of alcohol in HK for SMHK, it is still good to see that the value of retail sales in 2023 have rebounded strongly and also 2H 2023 is breaking new highs since Jan 2021.

2) Bar Pacific Revenue

Bar Pacific as its name suggest, operates bars/pubs in HK. As such we can see that revenue improved from 49.4m to 56.8m from 2Q 2023 to 3Q 2023. This is an increase of about 14%.

As Bar Pacific does carry Saint Mig products under its outlets, this carries some relevance but the extent is not big.

Nevertheless, it shows that there is increase in consumption trends for alcohol in HK.

3) SMHK Investment Property Long Term Sole Tenant

Perhaps a book value / deep book value investor favourite, there are some updates on the investment property that i have mentioned above earlier.

In this article, it is written that airtrunk, a data centre operator has rented the whole building at 2.5m HKD per month. With a lease of 15 years. The rental price represents a premium of 50% over the current leasing arrangements of multiple tenants.In this table, you can observe that the companies beer brewing business is really a joke from 2016-2020 as it is unprofitable. It has relied on its rental profit which has been increasing steadily since 2016 as well.With this new leasing arrangement in place, it should pave the way for a further increase in 2023/2024 minimally.

4) Improving International Operations Margins of San Miguel Brewery

From 2020 onwards, operating margins have generally improved and net income / operating income has followed suit as well. 2023 will likely have best margins since 2020 and therefore the improvement in margins could be a sign of better cost control.

This is definitely laudable.

Conclusion

This year marks the 75th year of SMHK. While there are some activities held to celebrate the year, it remains to be seen if there will be any special dividends especially when it is very likely to have a good performance this year.

Even if in 2H it does not perform as well as 1H, the investment property's rental ability is expected to be strong and the company has enough cash to cover the whole liabilities while having an investment property that covers its current market cap.

With everything mentioned above, i feel that it deserves a place in my portfolio.

However, the 'cap' on exports still lingers in my mind as it might have cap how high the profits can be in 2H 2023. On hindsight, i might be overly harsh for a 3.70 PE stock that has enough cash and deep value asset........

No comments:

Post a Comment