Part 1 will be relooking some of the transactions done this year as well some talking cock and spamming K-Pop photos. As there are still a few days left to the end of the year, it is still early days to be talking about returns.

After all anyone with Tencent / Netease or china game stocks will know that doing the review on 21 December vs 22 December will have made a sizable difference on returns.

The year started positively as the first slam dunk movie made a good impact in Hong Kong and Taiwan, which subsequently led to a rise in Medialink Group (Hkex:2230) Share Price and i was able to sell it at a decent profit. Medialink Group was the distributor for First Slam Dunk in Hong Kong and Taiwan.

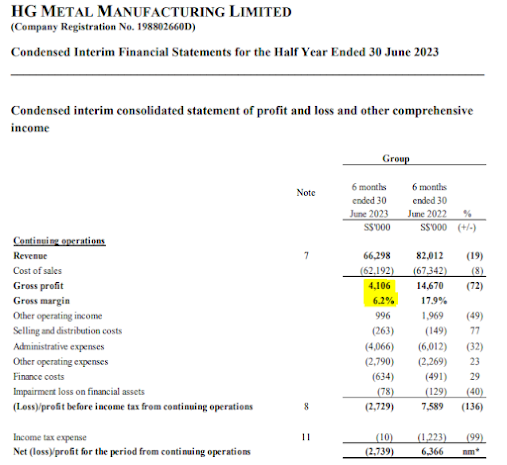

Following which, HG Metal reported poor results in February 2023 and i have sold them at 0.355. Although the share price did went higher than 0.355 on the back of some share sale news, last i checked, it is at 0.28 now and the 1H 2023 Results was bad as the company was loss making on the back of poor revenue

Meanwhile, in the subsequent months, some results trading went well while some went south.

Trades that went south/ sold at a lower price

Zengames (Hkex:2660). Sold at 2.69 in Feb. It was 4.51 as of 22 December 2023 despite the crackdown that happened to game industry.

Sutl Enterprise. Sold at 0.545 in March 2023 and 0.55 in April 2023 and the current price is 0.67

Baguio Green. Sold at 0.59 and 0.60 in August. Current Price is 0.73

AV Concept. Sold at 0.3. Current price is 0.36

Among the 4, i am most positive on Sutl Enterprise.

Trades that went well

AAG Energy. I guess it went well since profit was made. But the lowball offer went through. As such the returns made from YTD was around 10%

Ossia Intl - I shared my view in a previous post in April 2023. After the post, i was still adding it . My buy price ranged from 0.114 to 0.133. It hit a price of 0.16 to 0.175 in May which i took the opportunity to sell all of it. Fate and Luck seems to have decided that it would be a profit after all.

Build King- Bought in when i saw Wai Kee mentioning in its profit alert that Build King did well. And as expected it did well and i was able to make 10% on it.

Verdict is not out

This applies to the stocks in my portfolio as i am still holding them and anything could happen. Although some stocks had a good run in share price (e.g Huationg), i am still holding them as i believe that they can do better but as always anything could happen so we will see.

Trends that caught my eye/ i observed this year (might be late in catching them)

1) Japan.

Japan Stocks have rallied greatly this year. Oriental Land (Operates Disneyland and Disneysea) is up 40% this year. Itochu Corp (A conglomerate pick by Buffett is up 42%). Toyota is up 39% this year. Nissin is up 39% this year.

However, coming with it has is the depreciation of yen. It was 97 at the start of the year and we are finishing the year at around 107. This has in turn led to high tourist numbers in Japan. October 2023 figures have already exceeded pre-covid 2019 numbers.

2) Slowdown in Semiconductor in play

As seen from TSMC Revenue, we can see a slowdown in progress. While it varies differently across different companies, the general trend is in play and as such it is rather likely that the SG Semiconductors (e.g UMS, Micro Mechanics, Frencken will have a revenue fall)

This is actually a worry for the factories that produce and export towards US. For example garment export to US has fallen as destocking continues.

In fact, when i was researching on Cap Export from Bangladesh to US, the data does not bode well either.

Short Thoughts on the year

Overall, when i look at the things i have done in 2023......it looks like i have done much lesser research this year. Which is a product of lack of motivation / some depression/ some willingness to spend more time on K-pop and travelling / work being somewhat busy which is unexpected.

Also, as the portfolio was in gain at August and in decent position, flashback of how i threw away double digit gains in 2018 to end the year in a loss lingered in my mind and i got more cautious in the 2nd half of the year, which explained for the lesser transactions in 2H (36) compare to 1H(58).

Instead, I tried to find out if i can find more different data for different sectors that i am holding and assess if they are useful to the companies i hold or i might want to hold.

For example looking at Domestic Retail Figures in HK to see if it affects San Miguel Brewery HK in the recent years.

Will share more on returns in part 2.

Time for posting K-Pop Pictures

If somehow you managed to survive to the end of the K-pop photos, then why not allow me to talk cock a little further into how i view china stocks in general recently. As usual i am talking cock so it most likely is wrong as i share my view.

The HSI has recorded a return of -18.89% this year. The tracker fund 2800 returned -15%.

In terms of stock picking, stocks that did well this year would be the 'resilient' stocks such as China Mobile (YTD Return 19.32%) and oil stocks such as Petrochina (YTD Return 38.66%)

Stocks that did bad.....well too many Ping An (-36.30%), Tencent (-17.96%), HKEX (-24.26%), Baba (-16.70%) .......

1) Property Market

A quick check on the returns of Property Stocks and Property Management Stocks reveal that negative returns are seen on the share price. For example Country Garden (-72.28%) and CG Services (-67.85%) other smaller caps that are on my watchlist such as Road King (-64.82%) , Central China Management (-51.59%)

The contagion has spread and also affected Hong Kong Property Counters such as Sun Hung Kai (-23.21%). Although that has to do with the high interest rate environment in HK as well as the poor HK Property Market.

In terms of profitability, property counters are still recording losses and defaulting on debts.

Country Garden recorded a loss and even gross profit is negative. Its property management arm will be making a large impairment as well.

I think in 2024, property companies will still continue to suffer as the industry continues to suffer. As long as the big companies are in danger, there will always be abundant of supply and this means that prices will remain depressed as companies are more concerned about cash flow instead of profitability.

The longer it drags, the more companies will be affected. Unfortunately, from how we have seen how Evergrande has took so many years and is still a zombie company, i feel that it will take a very very long time for the supply glut to clear. Especially when the economy is bad and folks are not thinking of buying property for investment any more.

For Property Services Company, most of them are writing off their receivables as property companies are unable to pay them. As such it will affect them as well as those 3rd party property agents like BEKE.

The thought that has been in my mind is, can the industry recover when the companies are still defaulting on debt payment / recording losses / impairing left right centre?

My thought is that it will not and as such if the company fundamentals do not improve or if we do not see any big transactions of land owned by companies in financial troubles being purchased by state owned companies, then it is unlikely that it will recover.

2) Economy

China is expected to record 5.4% of economic growth in 2023. But when we take a look at the industrial profits, it seems to be saying a completely different story.

As such, for shareholders it seems to be bad as profits are on a downwards trend.

A look at the retail sales reveal there is growth seen

Travel is back as well in China as China Tourism Group Duty Free Corporation Limited recorded a gain of 27% in revenue in 3Q 2023.

And when we look at other indicators such as PPI and CPI, it continues to fall as well.

So it is a weird sight as corporate profits are down but sales are up and there is economic growth despite price fall and production price fall.

3) Employment

We have heard of the youth unemployment rate data being removed. But the overall unemployment rate according to official data has been decreasing.

4) Random 3Q China Sales

Nike in Greater China. 3Q 2023, 8% Revenue Growth Excluding Currency Effect.

XTEP = High Teens.

As such, it supports the thesis of sports products in China being strong. While instant noodles sales at Nissin for the China Region has recovered, it seems like headwind still persist.However, if we look at some tourist numbers, they continue to look good.

Shanghai Disneyland has broke pre-covid average daily numbers. With Zootopia opening in December 2023, it will serve as an impetus for 2024.So yeah, for the back end of the year, i guess travel related in China might be where i want to take a look at if any. With deposits falling, this might spur more consumption or investments. However, with investing looking very difficult in China with the many crackdowns as well as property downturn, perhaps some might prefer spending it instead,

5) Crackdown on Tech Industry

After tuition industry crackdown in 2022, we have seen recent crackdown in the game industry in December 2023 as a paper asking for opinion was issued. The fear is that usually such papers do happen to be real and in chinese there is a saying '无风不起浪' which means that waves are formed because of wind. As such, i believe the officials would not prepare the documents to seek for opinion if it was not going to happen.

I think of it like going to supermarket but every item is not on discount. Will it deter folks from playing the games? I guess it might but it is unlikely. However, it is likely to restrict spending and revenue gained from promotions that promote spending. One of the biggest advantage of these games are the economies of scale of game products. Unlike buying a car / buying a property / buying a physical product where there is cost involved in producing an additional unit, the game products have no such concerns. Which means that they can easily give many promotions.

Having said that, the final verdict on what is allowed and what is not allowed is not out yet but it seems like some folks have had enough of it and it led to the big sell down.

Thinking about that, what can be hit next? One might ponder. Would it be pricing of premium alcohol? Would it be pricing of tobacco? Would it be livestreaming being benefitting companies too much or benefitting live streamers too much such that the products sold are not of good quality? Would it be taxing on companies that are too pollutive?

We might have to think what is vice or bad in terms of Chinese sense for the people. In Chinese there is a phrase 五毒 = 烟酒嫖赌毒 . Which means the 5 vice are Cigarette, Alcohol, Prostitution, Gambling and Drugs

While not taking the term literally, we have seen how mobile game can be drugs as people can be addicted to it. As such, could giving rewards to streamers or excessive buying on livestream shopping channels be a vice?

Could Douyin or Kuaishou, watching too much of these short duration videos be an addiction?

Could over-relying on food delivery riders be an addiction as this leads to people being fat or obese?

There are many possibilities and many ways to screw the tech industry if they want to.....

No comments:

Post a Comment