Since YTD returns are still positive, the posting continues for now.

Today i will be sharing about a Hong Kong Stock that has been on my watchlist for close to 3 months.

Why HK Stocks? Well i have a better record recently in HK Stock Investing compared to SG Stock Investing hence it there is the bias. On a less serious note, there are probably like few SG Stocks i might be interested in but i probably will refrain from sharing this time.

Before we look at what the company is and the reasons to buy,

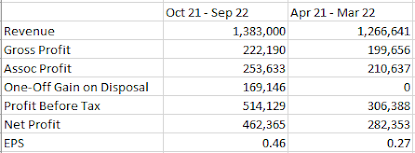

Lets look at just financials

From this financials, i can tell that the company has found its way back into good profitability. In comparison, the 6 months results has already exceeded half of the previous FYs.

In terms of ratios, it has improved and has the company has not increased its inventory to do this.

Associate Profit is also increasing year by year. Although it is worth noting that results has been boosted this year by one-off disposal.

Taking a look at its 3 year chart, the company seems to hit its peak in July each year before retreating. However, it is still much higher than in 2020 which means that its improving financials has been recognized by the market as well.

Although it is puzzling that the current price is not at its peak given that its financials have improved. Which prompts us to take a closer look. Can this be the stock that will do well?

Company Name : Yeebo International Holdings LTD

Ticker: 259 HKEX

Investing Thesis: Investing in this company is akin to playing premium poker hands at Wynn Macau

Folks who know texas holdem will know that the strongest hands are AA while premium hands includes high pairs as well as suited/ non suited AK AQ etc. These hands when in an all in scenario before any cards are dealt, have the highest chances of winning unless they are against similar hands.

For example your chances of winning when you have KK vs an opponent with QQ is at least 80%.

But of course, you don't get these hands all the time and as such you end up turtling or just playing tight. This company would be the same as it requires lots of patience and is not a company that is likely to blow up unless you open with the premium hands sooner with the help of luck.

Back to Reasons to Invest. 3 Simple Reasons.

1. Improving Financials and Fundamentals

For simplicity modelling reasons, i assumed that 2H of this FY will be same as previous FY to get a feel of whether profitability has improved.

The simple modelling shows that EPS has improved assuming same business conditions for 2H for both FYs. However pros in investing will know doing this is just pure bullshit because no one believes conditions ever stay the same. Or such an assumption is just for show.

While it is hard to estimate the revenue and profits of its main business which contributes 33% of normal profits, we can estimate the associate profit. Most of the associate profits (around 90%) comes from Nantong Jianghai, a listed stock in China (SZ:002484)

I know what some experienced folks might be thinking but lets keep the exciting part for later.

To estimate if business conditions has improved, lets do the backwards investing method. A method that a few jokers like me still use. We shall compare Nantong Jianghai Profits from Oct 22 to March 23 vs Oct 21 vs March 22.

Well we have a winner, profits improved by 45%. Which means that Associate Profit is likely to contribute a higher level, based on its 29.1% share, a simple estimate is 108m HKD, while it is lower than 1H in the current FY, it is still higher than yoy.

2. Deep Value in Associates.

Apart from getting the improved financials via improving results of its associates, the company benefits from an appreciation of share price of its associates and has deep value.

2 Associates it owns is 35.1% in Suzhou Qingyue and 29.1% in Nantong Jianghai

Suzhou Qingyue Market Cap: 5.29 billion RMB

Nantong Jianghai Market Cap: 16.2 billion RMB

Implied Stake Value: 7.03 billion HKD

Current Market Cap of Yeebo: 2.73 billion HKD.

As such, buying the company is buying the implied stake at a book value of 0.4 and getting another free business which contributes 1/3 of the profits and has improved in revenue and profits as well.

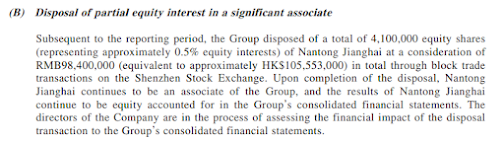

3. First Divestments in 2022.

Value is useless unless exercised. The same goes for waiting and playing only premium hands. You can have the best hands but when you raise and everyone else chooses not to play, you don't get much from these hands.

The same is can be said for Yeebo, it takes both hands to clap for value to appear. One is having the cards and the second is someone playing against you.

Therefore, Yeebo needs to sell the stake for any immediate value to boom, however they can also play the long game and just reap improving profits from it as well. Which makes things easier compared to poker.

Folks will be glad to hear that in 2022, Yeebo has divested 10.4 million shares or 1.3% as of Sept 2022. They further divested another 4.1 million shares subsequently in the same year.

They now hold 246.1 million left. As you can see in these 2 disposals, gains have been made as these associates are trading at market value above the book value.

The implied stake is worth 7.03 billion but on its books it is 1.73 billion.

Conclusion

Yeebo is a company that has conducted many share buybacks and has paid dividends regularly with a special dividend paid after the disposal. In fact the disposal is its first ever since the acquisition of shares in Nantong Jianghai in 2000s, as such it makes me believe that it might be finally in the phrase of slow disposal and profit harvesting

Even if it does not, the improving results of Nantong Jianghai will benefit the company.

There are other things such as fundamentals of Nantong Jianghai and Suzhou Qingyue to read up and be kept abreast on as well so it is not risk free as nothing is in stocks anyway.

If poker illustration is too hard to understand, then think of it like having invested in a farm that has 25 chickens laying quality eggs that increase year on year. You can sell some of your stake in the farm away at a very good price the marketplace is offering to buy or just continue getting your profits. Being the largest shareholder of these chickens but not managing the farm, you would be kept abreast of the developments of your farm and whatever information that the marketplace will be slow to react.

As for the main business of Yeebo, they engage in LCM/LCD Modules which is something that a lot of taiwan companies can do as well. Therefore, it is not any exciting business from the outside although i believe that should they introduce their company more often to the media or public, we will be able to understand that part of business better.

Due to ongoing complications of my own finances and my view on AAG Energy as well as other hkex companies, i will refrain from commenting if i will add in the near future.

No comments:

Post a Comment