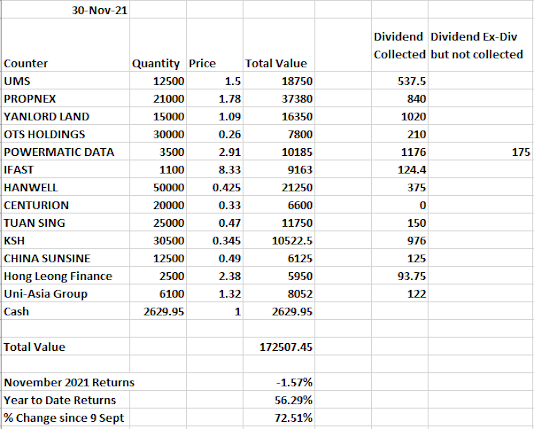

After taking a break to consolidate my thoughts and my stance towards investing, made a couple of changes to my portfolio.

Surprisingly, i have made my single largest equity purchase this year it was a stock that was not even on my watchlist before the hiatus.

However, i guess i have decided to go bonkers to take some risk that is unwarranted for.

(Praying that things will work out)

Details about the Counter

SGX Stock (Lol i know, its the boring sgx again)

Market Cap : Less than 100 million SGD (Lol i know up to trying to play small and micro caps again)

Industry: According to SGX, it states automobiles & auto parts as well as tires & rubber products but actually to me its more of property development as the main business and there are other side business such as selling industrial goods.

Profitability: Unprofitable since 2019.

So why did i purchase the counter?

1) Company has net cash that is around 60% of its current share price. Alongside a price to book value of 0.58, i would say there is value. However i know what jokers will say, its a value trap.

Obviously i did not buy the share thinking of 2x or 10x or 5x., if you are then you should stop reading and start searching on youtube for multi bagger videos.

2) Company is giving out 2 subsidiary shares for every 3 shares held. Hence 1 share is entitled to 2/3 of the subsidiary shares. Probably by now if you know about it you will know what company it is. Though i will also say it at the end of the post. What makes it interesting is that the net cash calculation in point 1 does not include these shares.

Hence based on the trading price on 16 November 2021, the 2/3 of the share that is to be awarded + the cash in the coy equates to 119% of its current share price.

As such i am getting the other businesses of the company for free.(Though they are unprofitable as mentioned earlier)

3) Company's new business scope offers some sort of prospect. The company is expanding into affordable housing projects in Malaysia. Considering that these houses are for the B40 (Bottom 40%) of salary of Malaysians, these houses are selling for very cheap prices of around 100,000 rm to 200,000 rm. I have looked at Lagenda Properties Berhad, a major player in the affordable housing projects in the industry and concluded that this business scope is do-able as there is demand for it and the main difficulty will be in individual companies attempting to keep the construction price low.

The CEO of Lagenda Properties Berhad is also bullish of the affordable housing projects in Malaysia (Not sure which CEO would not be bullish in something they are investing more in) and said that net profit after tax margins of 20-25% is possible. However it takes time to build the houses. The good thing would be that the land is very cheap for these projects and as such it is not as capital intensive as 1 might imagine about in conventional property development.

4) Turnaround in the subsidiary company (the company whose shares to be given out). The subsidiary has been in my watchlist since 2019. However i was not confident on pulling the trigger because of company events that has happened to the company such as funds being frozen and i could not see their diversification strategy working out. However, its latest result offered some glimpse of hope that a turnaround could be possible.

Firthermore, their secondary catalyst(everyone's favourite word except when talking about transfer to catalyst listing) has finally shown some traction having been talked about since 2019. I was surprised that on the following trading day after the announcement came out, the price showed only a small upwards movement on small volume.

The second catalyst is actually a land surrender back to the China authorities.

(Book Value is 8.4million RMB, cost at 329 rmb/sqm

Management's obtained valuation is at 2707 rmb/sqm

Which is around 8 times of book value)

Of course based on the image above, the estimation is that the fair value of surrender should be around 8 times of the book value of the land. Which equates to around 67 million RMB. This equates to a cash amount of 14.22 million SGD, or 61.4% of its current market cap.

Unfortunately, the government has decided to offer only 42.9 million RMB. Which is around 38% of the market cap. As such, it is undecided if the company will renegotiate but a decision will be out in less than 30 days.

Adding to a 3rd quarter result that the new business (loans and factoring in Malaysia) has shown some profitability due to increased revenue. It becomes more compelling.

(3Q Turnaround)

(Increase in Scale and turnaround in Financial Solutions) (3Q a significant pickup in revenue and contribution to bottomline as it only made 901000 in 2Q while in 3Q its 2826000)

I have the belief that with the economy in Malaysia starting to pick-up due to reopening, the risk of defaults should start to drop and this would allow the financial business to be less prone to default risk. Although this belief is as flawed as me believing that my salary at least earning 3500 now but I ended up at a much lower level currently.

(Balance Sheet)

On a balance sheet level, the company has 65m cash and 71m receivables (due to its loans and factoring business).

If we were to be a noob analyst and take the receivables and pay off all the liabilities. We get 65 million rmb of net cash and add the 42.9 million rmb from the surrender of land, this equates to 107.9 million rmb or 22.89 million SGD

This equates to 98.8% of the market cap. Alongside a turnaround business, the above factors convinced me despite the many problems the company has.

What can go wrong? *Thinking out loud*

1) Money frozen again by the subsidary company.

2) Negotiations go wrong and a bad offer is given.

3) Defaults in the loans business

4) Affordable Housing turns out to be unprofitable due to poor project management

5) Sudden change in unpredictable events resulting in the shares of the subsidary not being given out.

Revealing the Company

(GRP Limited SGX: BLU)

Revealing the Subsidary Company

(Luminor Financial Holdings Ltd formerly known as Starland Holdings)

Just to clarify in case the post is as confusing as it intended to be i bought into GRP Limited.