Perhaps not known to many people, a tech firm has been listed on the Gem Board of Hong Kong Stock Exchange since December 2016

Anacle Systems Limited is a company that has business in 4 segments

1) Providing Real Estate Solutions

-This is in the form of its Simplicity software that has well established clients such as Capitaland and SPH Reit

-It is a real estate / facilities management platform that is available in traditional software sales and Software as a Service (SaaS)

-It allows for monitoring of various factors such as workflow automation, gross turn-over, rental billing etc.

2) Providing Smart Utilities Management Soluitions

-This is in the form of Starlight, its water and energy management solution.

-It is available in traditional hardware and software sales, and via SaaS as well.

-Its customers include Jewel and Electricity Retailers in Singapore's Open Electricity Market

3) myBill Utilities Revenue Assurance

-This is its 'utilities revenue assurance SaaS Platform, which is the 2nd largest in Singapore. The market leader being Singapore Power, a brand Singaporeans will not be unfamiliar with.

-Its client in this field is I-Switch and the revenue model currently serves more than 100,000 consumers

4) Online Venue Booking Portal

-This is in the form of its largest venue sharing portal(http://www.bigspacemonster.com)

-It has both a mix of venues provided by private sector as well as public sector.

-Whether u would want to find a place to stay, a place to have a birthday party, a place to have a team bonding session, a place to exercise or a place to have a meeting, a place to conduct your classes or simply a place to practice presentation skills. You could look up the site and find a place to rent.

What I like about the Company

1) Growth Opportunities

-The amount of growth opportunities presented to the company are plenty. It has a good orderbook(over 40 million with over 20 million near term) for its Simplicity Platform and its presence of usage by major operators are a show of its quality.

-Its Smart meter the Tesseract has been shortlisted for the smart meter project which enables it to tender for the roll out in 2023 and beyond. With 200 000 in 2023 and an estimated 1.4m between 2024 to 2026, there is a market for its product should it be successful in its tender.

-Singapore Power contract ending with PUB and City Gas which gives gives a chance to Anacle to compete for the billing segment using mybill

From my point of view, i could at least see where the growth could come from.

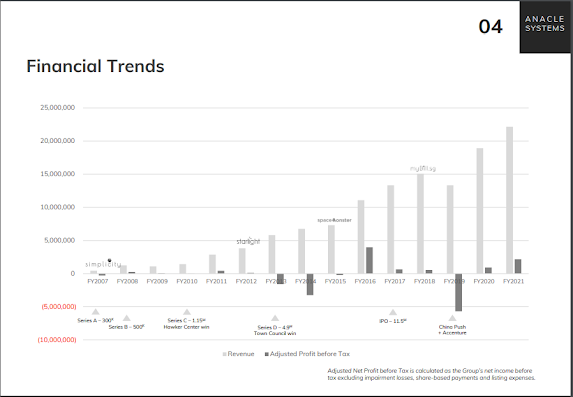

2) Increasing Revenue over the years

-Across a longer term horizon, the company has shown growth even though the growth is not consistent across years.

What I dislike about the Company

1) Valuations

It is currently trading at about 11 to 12 PE, a company that is trading at this valuation is very cheap considering that SaaS companies are trading at negative PE.

When looking at the Price to Sales, Anacle has a sales of 22.1 million SGD and a market cap of 141.39 million HKD. This gives a price to sales of 1.11 which is fair cheaper than companies like Weimob(around 9) and China Youzan (around 9)

However considering that it made only 2.1m in the latest FY 2020 and around 0.9m is from government grant, it all adds up to a company that has very low bottom-line and has a record of very volatile earnings.

2) Competition

The competitors in the market are huge competitors such as Singapore Power which are well established and well backed. While the opening up of the market will provide opportunities, it remains to be seen if these opportunities are 'opened' for show or if they are really awarded to smaller players.

Conclusion

This company is an interesting company that i will keep an eye on. However, it is a company that at the current moment i will not consider to invest into.

While i do not deny that it is a company that could be a multi bag should it be able to scale up and increase its revenue tremendously due to the ease of SaaS model as well as the potential customer gains and market share it can achieve, it is a company that has yet to pay any dividends (due to its stage where it is trying to grow).

Lastly, from its ipo price of $0.81, it has fallen to $0.35 today and it is probably justified as its unprofitability in FY 2019 due to its china expansion has erased the small profits made in the previous FYs and recent FYs.

When its profitability is stable is probably when it will fit my appetite. Till then, it will only be a company to keep tabs on.

No comments:

Post a Comment