Had nothing much to do for a sunday (finally) and decided to revisit a friend that has brought up some profits this year to see if more profits can be made.

Ossia International is poised to release its half year results in November.

Once again for folks who are unsure what this company is about, i have wrote about it in a previous post

Taiwan Retail

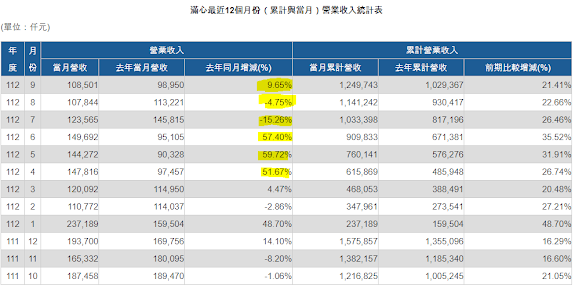

Looking at its closest competitor , Munsin, it has performed well from April 2023 to September 2023

A rough calculation puts revenue at a 21% gain. As such, while the correlation is not high, it operates in the same space as Taiwan Retail Segment of Ossia.

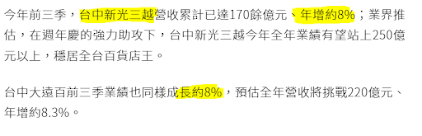

If i were to take a look at the departmental store business in taiwan, it has been doing well as well

Once again, a common knowledge that the highest revenue generating departmental store is in tai zhong and not taipei as tai zhong is where a lot of the wealthy (semi conductor related industries) reside.

2 outlets have been opened as well from April to Sept. Columbia in Lalaport Taizhong and Kangol in Tainan.

As a whole, 1H 2023 is usually a lull period for Ossia's Taiwan Retail as the weather gets hotter and people have lesser need for cold wear but looking at the growth in departmental store and Munsin, there are some hopes that revenue can improve and a turnaround can be achieved.

Harvey Norman Operations

This is where it gets tricky. But that is investing and its fun when its tricky and unpredictable. If it is predictable then its really boring.

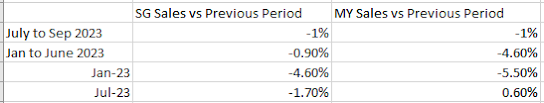

Looking at Harvey Norman's Revenue Update

We are interested in knowing from April to Sep 2023 how it has went. We know that there is only a modest 1% fall from July to Sep 2023. Considering the slow retail landscape, i will take this result all day every day.

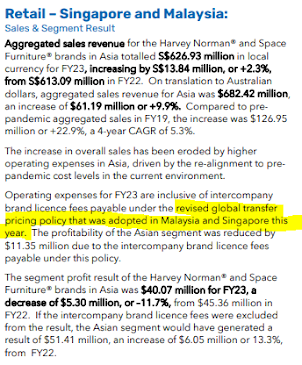

Due to Intercompany Brand License Fees, profit has came in at half of the previous period. There are many questions to ponder. We know it was introduced in 2023 but was it in Jan or in April? How is this fees expensed?

In any sense, i feel this big drop in profit might affect the profitability. We will get a real 100% feel of it when Ossia releases its results.

After all, in its 6 months results from Oct 22 to Mar 23, there are only 3 months of 2023 and in the 3 months of 2022 there was 6% growth in revenue in the SG and MY sales but profit actually increased 4.5% in the 6 months.

Conclusion

Digging deeper, we found the reason for a weaker SG and MY profit contribution that might be a big worry for Ossia. Fortunately, the business's sales have held up quite well and operationally they are fine its just an internal charging via increase in branding fees. I might have been tempted to consider adding if the profits was 24.44 million instead of 13.1 million.

As of what i have seen, the answer is an easy no. Considering the 1.8 cents of dividend paid out this year, the current price of 0.149 still puts it at a relatively high position this year. I am afraid that the 6 months of brand licensing fees might put profitability under higher pressure and this would be a new norm going forward.

A profit reduction in the associate of anything less than 40% would be a great joy to behold.

Though if i actually get it right that associate profit fell by over 40%.....it would be really wtf.

No comments:

Post a Comment