Recently i have not been doing much actually. Just really 2 short term plays. Hand got itchy and decided to do some stuff. I am not done yet with the itch, there should be a few more things to be done in Late Oct or in November depending on the upcoming trends that i observe. As there would be many companies reporting 3Q Results.

1) Rebought into AV Concept (Hkex: 595)

After i bought it, it went down a good 20% so i bought again. Literally Underwater yup.

The thesis for buying it is pretty simple, i saw a rebound in revenue in a firm (Co-Asia) that is operating in the same space.

In the previous few half year results, the revenue increase on a half year rolling basis have been in the same direction. As such, whenever Co-Asia has performed negatively, AV Concept's JV Arm would follow suit and vice versa.

AVPEL Group’s main customers are China’s major mobile phone manufacturers and component suppliers.

Also in a smartphone report in China, Huawei has gained grounds while Q3 2023 vs Q3 2022 is only a drop of 3%. As such, results should at least be better than the same timeframe last year.

After all, it is a punt and the risk are there that things will go wrong. As such, it will be short term and i will cap the exposure.

2) Sheffield Green Ltd IPO Application

As per my previous post, i think this is an IPO to try and see how it goes. I am not really inclined to hold long even though the revenue growth trend and prospect looks good. In fact, after seeing Niks Professional close 13% down for the day from its IPO Price, i am pretty sure Sheffield Green has more chance of doing badly compared to doing well.

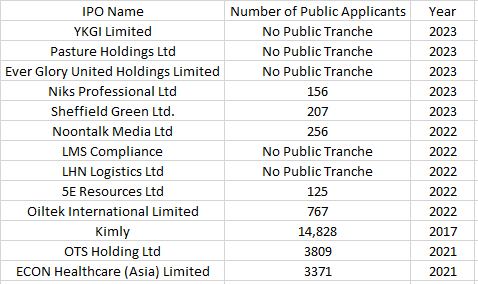

I am actually surprised with the number of public applicants. I guess any company that wants to list and saw the number of public applicants in 2023 will be shocked.

It has been a really sorry state of SGX IPO this year. Finally we have 2 public tranches in 2023 and we get really joker results.

When i see a figure like this, i wonder how SGX can position themselves to get more IPOs as well as let IPOs prosper so that the market is vibrant. But as anyone who read the SGX Results will know, they rely more on derivatives and IPO contributes a small portion of revenue.

I guess the heydays of IPO in Singapore are long gone. I am just ranting cause i believe monday sheffield will open underwater lol.

No comments:

Post a Comment