Tuesday, 31 October 2023

(October 2023 Results) How i would invest in the singapore stock market if i had 100k of spare money

Saturday, 28 October 2023

Recent Actions

Recently i have not been doing much actually. Just really 2 short term plays. Hand got itchy and decided to do some stuff. I am not done yet with the itch, there should be a few more things to be done in Late Oct or in November depending on the upcoming trends that i observe. As there would be many companies reporting 3Q Results.

1) Rebought into AV Concept (Hkex: 595)

After i bought it, it went down a good 20% so i bought again. Literally Underwater yup.

The thesis for buying it is pretty simple, i saw a rebound in revenue in a firm (Co-Asia) that is operating in the same space.

In the previous few half year results, the revenue increase on a half year rolling basis have been in the same direction. As such, whenever Co-Asia has performed negatively, AV Concept's JV Arm would follow suit and vice versa.

AVPEL Group’s main customers are China’s major mobile phone manufacturers and component suppliers.

Also in a smartphone report in China, Huawei has gained grounds while Q3 2023 vs Q3 2022 is only a drop of 3%. As such, results should at least be better than the same timeframe last year.

After all, it is a punt and the risk are there that things will go wrong. As such, it will be short term and i will cap the exposure.

2) Sheffield Green Ltd IPO Application

As per my previous post, i think this is an IPO to try and see how it goes. I am not really inclined to hold long even though the revenue growth trend and prospect looks good. In fact, after seeing Niks Professional close 13% down for the day from its IPO Price, i am pretty sure Sheffield Green has more chance of doing badly compared to doing well.

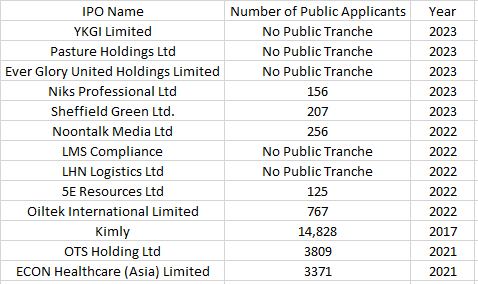

I am actually surprised with the number of public applicants. I guess any company that wants to list and saw the number of public applicants in 2023 will be shocked.

It has been a really sorry state of SGX IPO this year. Finally we have 2 public tranches in 2023 and we get really joker results.

When i see a figure like this, i wonder how SGX can position themselves to get more IPOs as well as let IPOs prosper so that the market is vibrant. But as anyone who read the SGX Results will know, they rely more on derivatives and IPO contributes a small portion of revenue.

I guess the heydays of IPO in Singapore are long gone. I am just ranting cause i believe monday sheffield will open underwater lol.

Monday, 16 October 2023

Thoughts on Sheffield Green Ltd (Latest SGX IPO)

Sheffield Green Limited will be looking to raise $6 million via the Catalist board. With an aim to IPO on 30 October 2023.

Introduction

IPO Closing Date: 26 October 12pm

IPO Price Per Share: $0.25

Public and Placement Tranche: 3.6 million Public and 20.4 million Placement

Implied Market Cap: $46.6 million

Nature of Business: Human Resource Service for Renewable Energy Sector

Company Net Profit: 2.4 million USD for 1st 9 months of FY 2023. (FY is from July to June)

Assuming a 3.2 million USD Profit. This translates to an implied PE of 10.6

What i dislike about the company

1) CFO Credentials

It is fair to say that this is a new CFO that has just joined in November 2022. However, he does not have a very ideal portfolio.

He was executive director for CW Group Holdings Limited from 2008 to 2018 (The company went bankrupt in 2020)

He was also CFO for Zheng Li Holdings from Jan 2016 to May 2019. While things were ok when he left, the company has went from 1.35 hkd in May 2019 to 0.11 HKD in Oct 2023.

It just feels like getting him is for the listing of the company. To be fair, CW Group Holdings has done decent while he was there. But it is just eerie things go bad after he left.

2) There is no need to list the company

With a net profit of possible 3.2m usd or around 4.38 million SGD, there is no need to raise just 1 year + of net income.

Looking at the balance sheet, the revenue recorded from June 2022 to March 2023 was 19 million. As such, i would not be too concerned with the receivable increase as i think that they have kept it well.

As such, it does not look like a balance sheet that needs extra funding to be listed through listing.

3) Key Man Risk

Kee Boo Chye is the CEO and i think whatever success is really due to his efforts. Having been in the oil and gas, marine industry since 2000 and doing manpower supply and human resource services business.

Moving into Taiwan in 2018 and Japan in 2021. This has definitely born fruits finally as the profits have come in.

Unfortunately, what this means is that are the clients trusting him or his company? After all the company is newly established in 2021.

The key counter-argument is that he will still be the major shareholder with 72.88% of shares after IPO.

What i like about the company

1) Good Margins

The company's gross margins have jumped leaps and bounds with the increase in revenue. It seems like it is able to reap some economies of scale in this aspect.

Profit Before Tax Margin of 17.4% and Gross Profit Margin of 27.6% is incredible when considering the large increase in revenue and it shows that the company might not have hit the ceiling yet in terms of profitability increase.

2) Easy to understand industry exposure

As long as demand for renewable energy increase in Taiwan, there will be an increased demand for construction of various facilities and as such there will be a need to continue requiring staff as well as more staff and the company will benefit from such tail winds.

If we look at this picture, we can tell that there is still some massive potential and catching up to do if Taiwan (the main market of the company) wants to hit their targets. As such, they might need more of the services by the company.

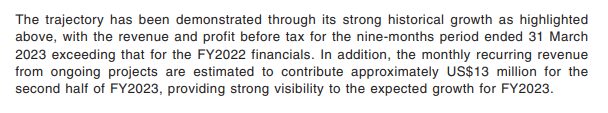

3) Revenue Visibility

I can only infer that it means that the last quarter of FY 2023 should have at least 6.5 million and that would be good as the 1st 9 months revenue contribution was 19 million.

The food for thought

1) Customer Concentration

2 Customers stood around 72% of the company's revenue. While it is tough to tell who the customers are and whether they will continue to use their services, it is revealed that one does steel manufacturing / offshore wind farm construction while the other customer does coasting solutions for the marine, offshore and industrial sector in Taiwan.

As such, i am not really sure how much the company really benefits from the renewable energy boom in Taiwan as it seems like not all customers are from the same industry

2) Number of Staff currently

Looking at this, what i think is that the number has peaked after 31 March and from 31 March to 15 September, it has reduced from 777 to 583.

What this means is that revenue for FY 2024 might not be as high as FY 2023 for now. But we still have to consider that it is a large increase in FY 2022 to FP 2023 hence we are not sure how long the higher numbers of 818 have been maintained.

Concluding

The company has plans to set up a JV in US and capture revenue in Japan , France , Denmark and Poland.

Looking at how it took them some time to set up a footing in Taiwan, i would probably say it would take some time for them to capture similar success in other countries as well and it would be a very long term project.

As this is a 'blue collar worker' focused company, i am not keen to call it a head-hunter company.

Looking at the Taiwan Offshore Energy Projects, it seems like there are quite some pipeline in the works and the expansion of wind energy is on the minds of the government.

Whether the company can capture the tailwinds of these offshore projects will be another question altogether.

Verdict

Potential of Growth: 5/5 (Taiwan is expanding offshore wind power projects)

Earnings Visibility: 1/5 (It is hard to tell if the company is doing well or not apart from macro trends of various country and their usage of specific renewable energy)

Valuation: 2/5 (Given that risk free rate is high now and this is not trading below 10 PE while HRnet is around 11 PE)

Conviction to List: 2/5 (Given that they are doing well and balance sheet is healthy)

Finishing the FY Well: 4/5 (I believe they will do well not considering the listing expenses)

Overall: 14/25 (Hit and Run on IPO Day or Sell on Result Release Day)

I think the current climate does not warrant for any long term holding of any small ipo as the required return is very high at the moment. Looking at how small caps seems to have little interest in the SGX, the expected return should be much higher.

However, looking at the improved financials, it could attract a few people to be onboard for this IPO and the renewable energy story in Taiwan is attractive as well.

Just that it is hard to monitor how well this company is doing as its customer base has shown that a new customer can stand around 30+% of revenue while a recurring one is also 30+%. Which means that a lot really depends on the execution of the company and in finding new projects / clients.