The computer is back up so i will celebrate by posting a post.

As the title goes, today's stock focus will be on Honma Golf (Hkex: 6858)

Honma Golf is considered to be a small player in the golf industry and a premium brand by many. A video of their golf club making can be found on youtube.

Layman Technical Analysis

Looking at the 5 years price chart, the stock has came down close to 66%. Looking at the current price, it seems to be trading at close to 5 year lows.

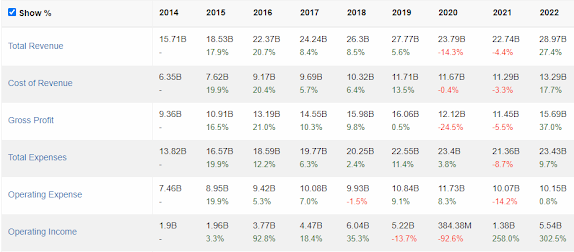

Financials

As of 2022 FY, its operating earnings is around 0.4 HKD, this translates to a pe of around 8.3 at current price of 3.32.

Reasons to consider this stock

1) Growth in revenue of golf club. 1 of its most important source of revenue, golf clubs have seen a growth in revenue under constant currency basis. Traditionally, 1H has been lower in revenue so there is a good chance that if the momentum continues, the company could see record earnings in this FY.

Mizuno's golf department recorded an increase of around 30% from April 2022 to March 2023. As such, i believe that Honma has some chance of doing well as well.

2) Golf as a sport. In the past i have the idea that golf is for the rich due to the need to book a golf course, hire caddies etc. But as technology and more mainstream golf has been introduced, folks can now play golf at simulators first as well as tee-up at driving ranges before going onto playing golf course golfs. As such, the market has opened up with the use of technology. These simulators are also available as 'club try outs' as players can now tee up at the stimulators to see if the golf clubs are suitable for them before purchasing it.

I believe the introduction of technology in Golf will allow Honma to have higher brand awareness as folks can try their club before deciding to buy it, Honma being an expensive brand would deter others to purchase and try it in the past without such simulators.

3) Small Market Share Compared to Industry.

In 2022, the golf club revenue came in at around 200 million SGD. This is similar to Mizuho (244 million SGD) but small compared to others like Callaway (1777 million SGD) and Titleist (748 million SGD)

As such, it is less likely to be affected by any headwinds and more of the revenue will be focused on its execution.

Lastly, the internal target / guidance given at the recent half year result release will be 10+% target in growth in revenue while keeping net profit at 25% Margin.

Reasons to not consider this stock

1) Choppy Earnings - As the yen has been depreciating against many currencies, this has resulted in net profit to be very volatile. As such, it is more important to consider the operating profit instead. Should yen continue to depreciate further, the company would be worth lesser as well as its balance sheet since it is traded in HKD.

2) China and Korea are the biggest markets.

This can be seen in 2 ways. Firstly, golf in Korea and China are both fast growing and under penetrated.

However, i think it might be a concern as China has seen soft consumption since 2023 while Korea's rapid growth might not be repeated and even see declines. Golfzon, a indoor golf simulator provider has seen a revenue decrease of close to 20%. Similarly, a post by Invest Chosun has mentioned about the headwinds in the golf market in Korea in 2023.

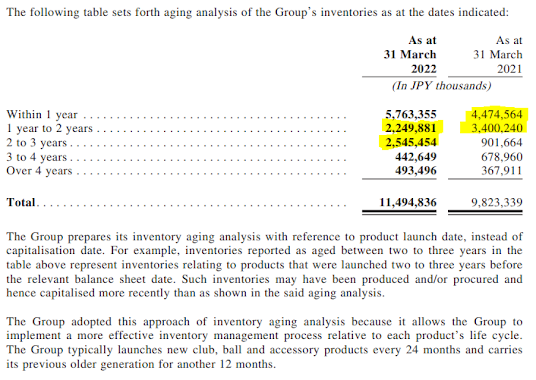

3) Inventory a Big Problem

Inventory is around 6 months of Revenue. Provisions have also increased by 50% across a span of 1 year.

2.2 million out of 4.4 million fresh inventory was cleared in the first year resulting in 2.2 mil brought over.

Out of 3.4 million (1-2 years) inventory, only 855k inventory was cleared resulting in 2.5 million brought over.

As such, there is a probability on increased provisions.

Conclusion

Premium Brand, Healthy Balance Sheet but revenue and inventory remains a concern that the company has to overcome. The fall in share price to a single digit PE is probably justified given the concerns of the company.

Given that peers like Callaway and Acushnet trade at 15 to 25 PE, Honma is definitely undervalued at 8.3 PE.

Unfortunately given the current landscape and how other golfing peers have performed from Oct 2022 to March 2023, i believe the 2H growth might be cap at 10-15% max.

Having said that, the company is still small and has ample abilities to make up for the macro headwinds. If the share price is anything to show for, it shows that the company has depressed investors more often than not.

No comments:

Post a Comment