Dream International is a company i have once held in before from 2017 to 2018 and i revisited it this year again.

It has just released a positive profit alert. While the alert was not a surprise, the magnitude of the profit is a positive surprise.

The reason for revisiting was pretty simple thinking any tom or harry can do.

1) Languishing Share Price

A glance at the share price and one might wonder what it has been doing the past 5 years as the share price has declined. Could it be a case of profitability being impacted? Lets find out a bit deeper.

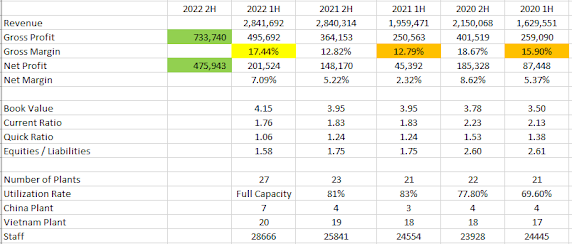

2) Revenue and Net Profit on path of recovery. Financial Health Healthy

A look at its revenue will show that it has grown since covid and its profit has also recovered. If we can have reopening stocks moving ahead of time and recovering in share price, surely a company like Dream International should deserve better valuations as it is also benefitting from recovery and has already shown a recovery in 1H 2022.

While ratios has came down, book value has increased and against a languishing share price, the premium reverses into a discount.

The green theme colors are based on the positive profit announcement that was made on 10 March.

This means that in 2022 would have made its highest profit since 2010.

3) Increase in Capacity

From the table above, one can identify that 'there is a possibility' things are finally starting to fly as Utilization Rate has increased despite increase in number of plants.

Looking at these 3 factors, i have felt that it was worth putting a stake to see how things might turn out.

But of course before that, i had to see what are the factors or reasons that might explain why this company is so cheap and what are the possible risks.

1) Higher Operating Leverage. As the plants increase, the company will have higher operating leverage and as such it will do better when demand is strong while if demand falls off, the magnitude of reversing into a less profitable positions is more higher.

2) Key Customer Risk. In 2021, its major customer accounted for 34.8% of revenue. The master sourcing agreement with its major customer also expires in 2023 which means the risk factor cannot be discounted easily yet.

3) Missing Money. In Feb 2022, the company lost its i-banking token and found out that 41 million HKD has been transferred to a non related account. While a police report has been made, nothing has come out of it yet. The risk of this cannot be neglected but it is safe to say it has been some time since that event and no new tokens were lost recently.

Conclusion

The decision to take a stake in the company probably took shorter than the time needed to write the figures out and this post itself.

Dream's decision to add plants even during covid shows a remarkable believe in its strategies and ability to secure and execute orders. In fact, the sudden addition of 4 plants in 6 months is so quick that it took 3.5 years to add 4 plants before 2022.

It will be hard to estimate the demand / orders the companies has as the major customer is only 30+ % of the company. However, the management's decisions seems to echo that demand looks strong. Hopefully the Annual Results release will shed more light

If we took a look at other toy manufacturing companies' results, we will see that Dream performed better compared to peers.

Dream International: 45% Revenue Growth in 1H 2022, 343% Increase in Net Profit for 1H 2022

Kader Holdings : 2% Revenue Growth in 1H 2022

Playmates Toys: -20% Revenue Growth for FY 2022 despite 25% Revenue Growth for 1H 2022. FY and HY still loss making

Matrix Holdings: 19.1% Revenue Growth in 1H 2022, 116% Jump in Net Profit for 1H 2022

Despite good increase in 2022, the same magnitude of increase in 2023 looks rather unlikely currently. But at the trading price of 2.70 on 11 March, the PE is less than 3.

No comments:

Post a Comment