If this post goes off, it means that i have passed my covid test in Korea and is currently there now for a few days.

I would like to share my own views on how i see the macro in general. Though i would put a big DISCLAIMER that i am not skilled / experienced in such things and is just purely my own small view.

(In a Nut Shell Based on My Knowledge)

America (Commentary)

-May 2022 annual inflation rate 8.6% driven by food cost and energy prices. Highest since Sept 2005, seems like an unchartered territory for most investors such as myself.

-Tech sell down continues, as of 14 June S&P 500 is already down 20% YTD. Nasdaq down 30% YTD.

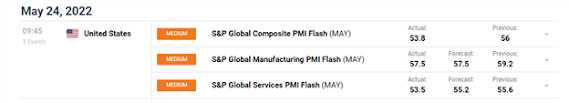

-Talks of interest rate hikes being quickened continues as PMI continues to be above 50 indicating the economy expanding.

(Manufacturing PMI 57.5, Services 53.5)

Views:

First off, i don't think that the US market is anywhere near 'cheap' especially we are a long way off the 2020 lows. While one can say that inflation has happened and you should have a higher index value to reflect such changes, then i would say lets add a 20% to the lows of 2020 as a rough inflation gauge.

Nasdaq low in 2020 is 6900 pts. 1.2 of it is still 8280 points. From this aspect, we still have 20+% more to go.

I think the key turnaround for tech companies will come when inflation leads to a decrease in expansion of the economy. Which will likely happen when there is mass sacking in various industries across the board. While there have been some notable sackings currently, the unemployment rate currently still stands at a rate that is below pre-covid and therefore some bad corporate earnings leading to companies sacking people will have to happen before we can see some actions being taken on interest rates etc.

With regards to energy, i feel that high prices usually dictate a poor economy. When demand is bad in the economy then oil prices will take a shock and this usually triggers the 'crash' amidst the depression. But due to covid and ukraine crisis, this can might have been kicked down the road due to demand for travel and production ramp up issues by OPEC.

As i do not invest in the US Markets, i do not have any equity that i can think of that fits a decent investment at the current time.

Asia (Commentary)

A quick look at the 2 index that i view the most, the STI and HSI.

The HSI is off its 5 year lows set earlier this year but it is still at a low region when compared across 5 years. With US negativity, i am not surprised if we were to see that level again this year.

The STI on the other hand has come off its highs although it is still at a high region when compared across 5 years. The strength of the asia regional economies will likely decide the strength of STI as the banks make up a good proportion of it.

For China, i believe that covid zero will likely be a mainstay until a vaccine of MRNA quality is made by china for the people in china. Till then, i don't think there will be mass opening up or opening of borders as simply put, the vaccine that is on offer in china is not good enough.

The economy on the other hand is a tough nut, it shows evidence of targets not being met although the gov seems to be very keen to push on all fronts to hit the targets despite lockdowns and all.

I still believe the economy will be bad, the targets are unlikely to hit if this lockdown continues (not covid 0 but lockdown).

As for china property, apart from negative i have nothing else to describe. Simply put, if people are on lockdown / struggling due to being unable to go into first line cities to find jobs then housing demand would be on a downtrend and would have to rely on 2nd and 3rd line cities to fill up the short fall.

This is unlikely to fill the gap because these cities have lower land value and selling prices compared to 1st line. Also it would be rather unlikely these cities have higher purchasing power as big companies tend to have factories at 1st line cities due to availability of talents.

In other words, the better jobs are usually found at 1st line cities. With real estate contributing 14-15% of GDP, this negative impact would be significant

For china energy sector, although prices have been rising, we have seen the authorities wave their magic pen and write down price control methods. As such, even though price increase is seen, the magnitude is unlikely to spiral out of control

(Reasonable price range introduced)

In line of this, i will be interested in positioning for smaller cap energy stocks as well as food/drink/ living essential companies as these companies are likely to be overlooked by general markets and have inflation hedge.

Although the price increase might be capped, this might actually promote healthy development instead.

An example of a company that i have looked at will be Kinetic Development (Hkex : 1277)

A small cap coal company that ticks 1 portion of my assessment but unfortunately scored badly in other portions. Although it has good earnings ability and pays decent dividend, the owner is associated with property company and has made use of the company to buy properties from its own property company. Also, it has engaged in numerous purchases of coal mines which will weaken its strong cash position it has obtained from a good coal market in 2021.

Another company that i have looked at will be my long time favourite Lam Soon HK (Hkex: 0411)

Earnings will likely be under pressure due to the rise in oil prices affecting edible oil, as well as wheat prices increase. This company has around 20+% of net cash (cash - all liabilities). It is a company that i will kiv and refer back when economy starts going bad and prices start coming down. But currently, bad earnings is expected to continue.

If i have to pick earnings growth company, i might want to consider these 2 companies.

Zengame (Hkex: 2660) : Price have retraced following a dividends declared not passed in AGM due to some compliance issue with the shareholding and as a result fund transfer out of china is blocked.

While their new flagship game launched in 2H last year have continued to perform solid (not as good as 2H 2021).

It means that earnings are likely to be higher than 1H this year as this year 1H did not include the new game. How much dividends announced will likely dictate the direction of this stock as management has said that they are working on it(though we will only know if this is true when the results release for 1H comes out in August). For more info please refer to my previous post on zengame here

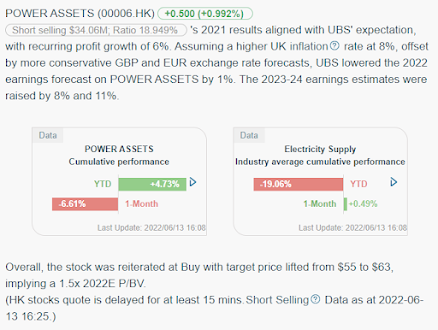

Power Assets (Hkex: 6)

Just pure play macro view thinking, i would want to go into something safer which is utilities and power assets fits the bill best.

One of its earnings driver comes from its 40% owned UK Power Networks Holdings Limited which own and maintain electricity cables and lines across London, the South East and East of England.

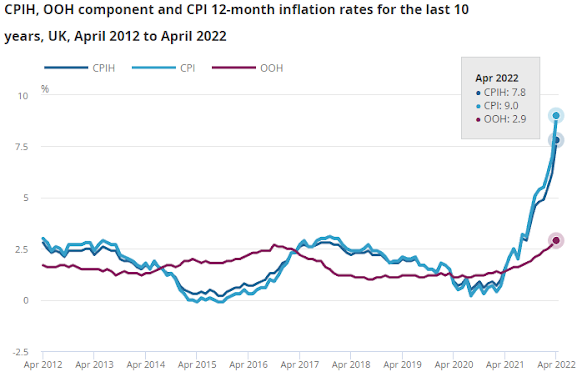

In March 2022, it has been rumored to have an offer made by private equity for £15b(around 143 b hkd). There might be some value unlocking there although in a year where inflation might be high, the valuation might have to be raised up again after higher data these few months compared to when the offer was made in March 2022.

(UK Inflation will benefit utilities)

For Singapore, i think it will benefit from the re-opening as long as it can cope with the impact of Covid. Bearing any disruptions such as new variant or a new outbreak that is too serious, we should see healthy grow in production and tourism.

On the flip side, we might have to worry about wage spiral inflation as this year has became a great year for people to quit their jobs and pursue higher paid jobs as they might have feel depressed due to the lack of wage increase in 2020 and 2021 by companies.

At the same time, some might find it stressful and quit to take a break.

Nevertheless, this is likely to drive up wages for lower entry jobs as these folks will be able to secure better opportunities due to the opening of economy.

In terms of sudden demand shock, i feel that it is unlikely as Singaporeans still have a very good savings rate. This is evidenced by the oversubscription of Singapore Savings Bond. Something that has not happened for quite sometime. As such, i do not foresee any flash crash in property. Perhaps a moderation in consumption but i believe it will not be negative yet.

Although we have been warned that a recession maybe be coming in Singapore, once again it is highly unlikely to imagine a very high unemployment rate without any measures done.

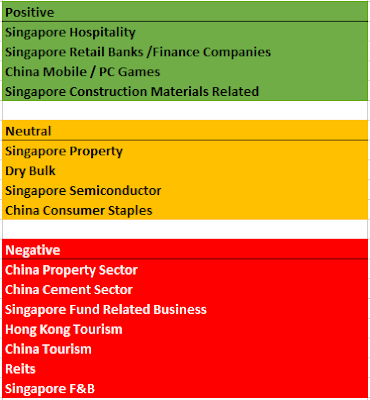

Having considered the above factors, the picks in the sgx market has to be quite selective. I will group them to 3 categories (High risk, Moderate risk and Low risk)

High Risk

-Luminor Financial

The ability to convince the selling party to accept shares that are issued with a value of $0.30 is something that has not been well priced in. This year should be a year of profitability with its loan business gaining traction and finally recognizing the relocation gains.

However it is high risk because of its not so ideal balance sheet following acquisitions, presence of shareholder loans.

-YZJ Financial

Explained before, view remains the same. High risk remains because of the unknown credit risk.

-HG Metal

Just a wild pick as i do not want to pick BRC Asia but i want to think that it would continue to benefit from the increase in demand of steel and prices of steel in Singapore as construction resumes and increases. The profitability of this company prior to 2021 is very very very very bad and hence it is in the high risk region.

Moderate Risk

-Hotel Grand

Way below book value, given the recent frasers hospitality takeover offer at book value, hotel grand remains value waiting to be unlocked or a value trap either way.

Company has managed to be profitable in its recent FY and there is some rental income to support its results as well

-DBS/UOB/OCBC

Interest rate beneficiary but key risk being bad market conditions will somewhat affect the stock and an earlier than anticipated recession

-Sing Investments and Finance

Interest rate beneficiary with deep value in the form of its property, might not benefit from wealth management as much unlike banks but should still benefit due to its main business being loans.

Low Risk

-Powermatic Data

Results are ok, a bit of a disappointment over the value unlocking not happening for now but the value is there and the company is cheap when considering value unlocking is taking place. Huge cash pile, simple balance sheet reduces the risk of its company by a lot.

-SUTL Enterprise

Results are muted due to impairment but not accounting for that results is actually good and this is a luxury services play which is less likely to be affected by inflation.

Considering that most of the liabilities is deferred membership income, the balance sheet is very healthy not accounting for that.

3 Stocks I would avoid in SGX

-Jumbo

-RE&S Holdings

-Japan Food

Not a fan of the F&B industry which is showing losses/ thin bottomline. For e.g Japan Food had 5.4 million of rental support and government grant while it made a profit of 3.2 million. Although its 2H results signify a turnaround with profits after deducting other income, i still feel that the labour crunch and rise in food and wages would affect the company.

Conclusion

I think as a whole we might be looking for a 1-3 years of depressed sentiments, returns that we have seen in 2020 and parts of 2021 is likely more rare now and we would likely have to be very rotational or value focused based to enjoy such returns.

Bearing in mind the downside risk remains as value might not be realized and rotational based might have been overheated already.