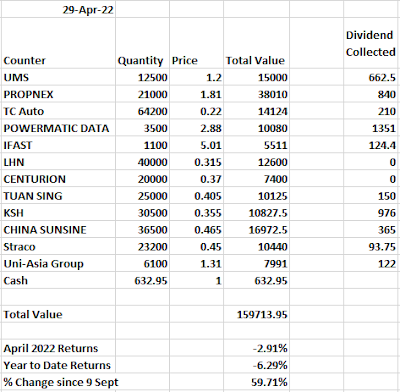

Most counters on the list detracted. It has been a bad April as well for the index.

In my opinion the key development was that the covid situation in china has gotten worse and there might be a need to relook at positions held in the list.

In terms of results, iFast has reported its 1st quarter of results and it looks bad which might have been more than expected given the poor market conditions would have affected the AUM amount and AUM Mix. With the news of not securing a Malaysia License, it seems like there will be head winds further and the guidance for the HK business in 2023 seems to have been slightly revised lower.

However with the low weightage of iFast in the portfolio (<4%), I am not really worried about it. Though a thought i have been curious is that despite all the attempt to promote the local fintech industry and encouraging them to take the big step, a company like iFast has failed in winning both the Singapore and Malaysia Digital Bank License.

Exited Position: Straco

Exit Rationale: Since Mid-March, the aquarium has been closed. Although the flyer has resumed operations, the aquarium is still the main income generator and it seems like golden week, a traditional

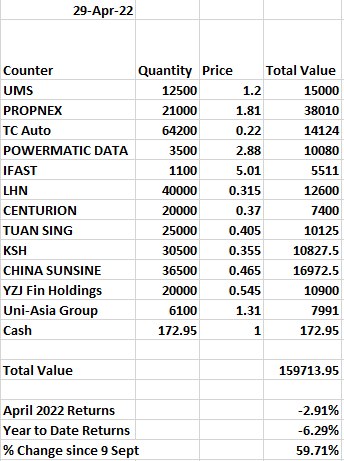

Entered Position: YZJ Financial Holding

Enter Rationale: The sell off on 29 April makes no sense and i anticipate a rebound of price when the buyback mandate kicks in. To put the company it in some simple numbers.

Current Share Price: 0.545

Price to Book Value: 0.504

Price to Earnings: 6.8

Default Rate: <5%, Recovery Rate: >70%

Going by the coverage ratio, there seems to be some leeway in case the debts do fail. As such, the current price represents a good discount. Of course we would need to be wary of the downside risk as there is little information on the debts and the potential correlation in the debts should there be a debt crisis in China as we have seen in the property space already. In such cases, the collateral might suffer a huge depreciation.

Another thing to look out for will be its profitability after it has shifted its strategy from 100% Debt Investments to 50% Investment Management and 50% GP Funds Business. This would need some time to bear fruit as well and in 2023 we will be able to see how the company balances short and long term profitability.

As such after replacing Straco, the allocation looks like this.

No comments:

Post a Comment