Tat Seng released its results on 23 February 2022. On a glance it looked ok and as such i had not planned to release a post or write about it. But after having some time to look at it over the weekend. I decided to write about some observations and thoughts about it.

Positives

1) Tat Seng records its highest profit in its past 5 financial years.

2) Dividends declared is also at its highest in its past 5 years. While it is not the sole highest in its history as FY 2016 was also 4 cents, the profit at FY 2016 was 15,974. Much lower compared to FY 2021 Profits

3) FY 2021 Revenue at record 5 year high.

4) Relative stable performance compared to peers

As some of its peers has not released its full year performance. I could only use their 1H and 3Q results as a rough gauge.

SH605500 森林包装 fired a warning shot as its 3Q 2021 was 14% lower than its regular quarter in 1H 2021. They made a profit of 287.9 million yuan in 9 months of 2021 while in 1H 2021 they made 201.5 million yuan.

This translates to a 86.4 million yuan made in 3Q 2021. On average, 1H 2021 they made 100.75 million yuan

Comparing to Tat Seng which managed a 12% net profit increase from 1H 2021 to 2H 2021, i would say Tat Seng has fared slightly better based on available data.

Negatives

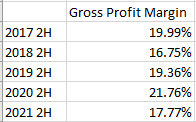

1) Gross Profit Margin for 2H 2021 was bad. The 17.77% margin recorded is the 2nd worst margin in the last 5 years of 2H.

2) Net Profit Margin for 2H 2021 was unimpressive. The 6.98% recorded is 3rd out of the last 5 years. Nothing impressive to shout about.

3) Increase in corrugated prices is not passed down effectively in 2H 2021.

Perhaps the biggest of all concern is that in this 2H 2021 is that the % of increase in revenue is lower than the % in cost of sales. This difference is largest in its 5 years. A main reason for its rather poor gross margins.

Another way to look at this will be to look at the 2H to 1H Corrugated Price Difference vs Gross Profit Margins. Whenever there is a positive price performance in Corrugated Paper from 2H to 1H, the margins are usually better. This has not been seen in 2021. Despite an increase in corrugated pricing, margins remain lower than 2019 which recorded a negative year.

4) Inventory at a high level. Corrugated Price in January 2022/February 2022 is depressing.

The Inventory at end of 2021 is at its highest level, while the price of corrugated has increased, the increase in inventory net of price change is still roughly 30%, a level much higher than its previous years. The reason given for the increase in inventory is 'increase in material price and stocking up more inventories in anticipating of increase in raw material price'

In January 2022, the corrugated price is 3900. It is 10.9% lower than the price in December 2021. The price in February 2022 is 3928. Not much of an improvement.

This is pretty critical as the cost of sales in 2021 was 298,344. This translates to a monthly cost of sales on average of 24,862. Which means that an inventory of 42,682 will last around 1.7 months.

This means that a possible 'buy high sell low' might have occurred in the 1st 2 months of 2022.

Coupled with the inability to pass on price as well seen in 2H 2021, a double whammy might be in the works and might result in a bad 1H 2022.

Perhaps the most interesting thing of all is that this trend has not been seen since 2016. As such, it is hard to tell how well the company does against a backdrop of a 10% drop in the opening month of the year in corrugated prices. I am not referring to prices and results before 2016 as this is not a 10 year series assignment.

Of course 1 way the company can try to get out of this will be to play the volume game and increase volume such that this trickles down more to the net profit.

While the inventory level might signify a possible action of such, it is still difficult to ascertain as in 2020 management stated that increase in inventory was due to 'in anticipation of higher business activities' while this line has been removed in 2021.

Conclusion

Going back to business prospects. 1H 2022 will be tough according to my estimations. The company has still managed to improve its revenue and profit across a 5 year trend. Which means that although it is in a cyclical industry, it has done its own improvements to what it can control to better prepare the company for the trends.

Current price of 0.77 represent a price to book value of 0.66, a yield of 5.19% and a PE of 5.5.

I feel that there is nothing to be surprised if results this year does not do well but even at the worst of years in the past 5 years, the company made around 15m which is 8.7 cents and around a PE of 9.

The payout ratio is also less than 50% currently.

Lastly perhaps not a big factor, the acquisition of a property in January 2022 in Singapore and starting up a new subsidiary in Guangzhou might not signal much but if the company is in a bad spot, i doubt that expansion / acquiring instead of renting would be in their minds.

No comments:

Post a Comment