Monday, 28 February 2022

(February 2022 Results) How i would invest in the singapore stock market if i had 100k of spare money

Sunday, 27 February 2022

(Long Post) Tat Seng FY 2021 Results Thoughts

Tat Seng released its results on 23 February 2022. On a glance it looked ok and as such i had not planned to release a post or write about it. But after having some time to look at it over the weekend. I decided to write about some observations and thoughts about it.

Positives

1) Tat Seng records its highest profit in its past 5 financial years.

2) Dividends declared is also at its highest in its past 5 years. While it is not the sole highest in its history as FY 2016 was also 4 cents, the profit at FY 2016 was 15,974. Much lower compared to FY 2021 Profits

3) FY 2021 Revenue at record 5 year high.

4) Relative stable performance compared to peers

As some of its peers has not released its full year performance. I could only use their 1H and 3Q results as a rough gauge.

SH605500 森林包装 fired a warning shot as its 3Q 2021 was 14% lower than its regular quarter in 1H 2021. They made a profit of 287.9 million yuan in 9 months of 2021 while in 1H 2021 they made 201.5 million yuan.

This translates to a 86.4 million yuan made in 3Q 2021. On average, 1H 2021 they made 100.75 million yuan

Comparing to Tat Seng which managed a 12% net profit increase from 1H 2021 to 2H 2021, i would say Tat Seng has fared slightly better based on available data.

Negatives

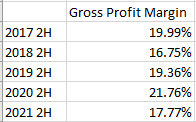

1) Gross Profit Margin for 2H 2021 was bad. The 17.77% margin recorded is the 2nd worst margin in the last 5 years of 2H.

2) Net Profit Margin for 2H 2021 was unimpressive. The 6.98% recorded is 3rd out of the last 5 years. Nothing impressive to shout about.

3) Increase in corrugated prices is not passed down effectively in 2H 2021.

Perhaps the biggest of all concern is that in this 2H 2021 is that the % of increase in revenue is lower than the % in cost of sales. This difference is largest in its 5 years. A main reason for its rather poor gross margins.

Another way to look at this will be to look at the 2H to 1H Corrugated Price Difference vs Gross Profit Margins. Whenever there is a positive price performance in Corrugated Paper from 2H to 1H, the margins are usually better. This has not been seen in 2021. Despite an increase in corrugated pricing, margins remain lower than 2019 which recorded a negative year.

4) Inventory at a high level. Corrugated Price in January 2022/February 2022 is depressing.

The Inventory at end of 2021 is at its highest level, while the price of corrugated has increased, the increase in inventory net of price change is still roughly 30%, a level much higher than its previous years. The reason given for the increase in inventory is 'increase in material price and stocking up more inventories in anticipating of increase in raw material price'

In January 2022, the corrugated price is 3900. It is 10.9% lower than the price in December 2021. The price in February 2022 is 3928. Not much of an improvement.

This is pretty critical as the cost of sales in 2021 was 298,344. This translates to a monthly cost of sales on average of 24,862. Which means that an inventory of 42,682 will last around 1.7 months.

This means that a possible 'buy high sell low' might have occurred in the 1st 2 months of 2022.

Coupled with the inability to pass on price as well seen in 2H 2021, a double whammy might be in the works and might result in a bad 1H 2022.

Perhaps the most interesting thing of all is that this trend has not been seen since 2016. As such, it is hard to tell how well the company does against a backdrop of a 10% drop in the opening month of the year in corrugated prices. I am not referring to prices and results before 2016 as this is not a 10 year series assignment.

Of course 1 way the company can try to get out of this will be to play the volume game and increase volume such that this trickles down more to the net profit.

While the inventory level might signify a possible action of such, it is still difficult to ascertain as in 2020 management stated that increase in inventory was due to 'in anticipation of higher business activities' while this line has been removed in 2021.

Conclusion

Going back to business prospects. 1H 2022 will be tough according to my estimations. The company has still managed to improve its revenue and profit across a 5 year trend. Which means that although it is in a cyclical industry, it has done its own improvements to what it can control to better prepare the company for the trends.

Current price of 0.77 represent a price to book value of 0.66, a yield of 5.19% and a PE of 5.5.

I feel that there is nothing to be surprised if results this year does not do well but even at the worst of years in the past 5 years, the company made around 15m which is 8.7 cents and around a PE of 9.

The payout ratio is also less than 50% currently.

Lastly perhaps not a big factor, the acquisition of a property in January 2022 in Singapore and starting up a new subsidiary in Guangzhou might not signal much but if the company is in a bad spot, i doubt that expansion / acquiring instead of renting would be in their minds.

Tuesday, 22 February 2022

(Full Divestment) Got lucky with Human Health - 3 Pointer From Downtown

In one of the previous post (23 January 2022), i had highlighted 4 stocks that could benefit from the HK Covid Crisis

|

Stock Name |

24 January

2022 Share Price |

22 February

2022 Share Price |

|

Kato HK

(HKEX: 2189) |

0.66 |

0.65 |

|

Bamboo Health

(HKEX: 2293) |

0.85 |

0.97 |

|

Human Health

(HKEX: 1419) |

1.18 |

2.24 |

|

Town Health

(HKEX: 3886) |

0.38 |

0.42 |

Apart from Kato HK which is flat, the rest recorded gains.

After careful consideration following that post, i have initiated a position in Human Health. The analysis was rewarded as they have released a positive profit announcement on 11 February.

In what is a very fortunate turn of event, Mr Market decided to give it a much better price and i have divested fully.

Although the PE is still low (less than 6), when i picked it it was at a PE of less than 4 and HK had more vaccination in 2H 2021 than 1H 2021. Also it was trading at close to book value (around 1.06)

Personally i feel that vaccination drive should subside in the near future as testing becomes priority and the ramp up will be ending soon. In fact the severity of the situation in Hong Kong has resulted in increased vaccination capacity which meant that it is likely more people will be vaccinated sooner.

As such, while it might perform well in 2022 1H, it is unlikely that it will perform superbly in 2022 2H unless there is 4th, 5th jab or an increased spending in outreach activities to secure more %.

The chance for it to happen is there and its worth waiting if the price was closer to the initial purchase price of 1.18 but at current price, it is just too attractive to sell as there seems to be some near term frying.

Overall, i did not intend to hold it for a very long time as i was searching for short to mid term ideas to cover back the losses made from IGG.

Just lucky and glad that this trade has managed to cover it, in terms of time period and returns, it is probably my best (Around 1 month, 80% returns)

Update on other companies mentioned in the previous post

Town Health has also released a positive profit alert although in terms of PE, it is still trading at 10+ PE. The final result will be decided after deciding if any further impairment losses are needed from their promissory note. As the number of cases only spiked up towards the tail end of December, i am quite certain that their 1H 2022 results for Hong Kong side should be good. However, as for the China side, it is quite hard to ascertain.

Bamboos Health released a decent set of results. It was not as good as the previous 6 months but still decent enough. With the current pandemic in HK where beds have to be outside hospitals, staffing is definitely a concern and their services will be in demand.

One thing that came to my mind was that even in endemic like Singapore, we have seen reports of healthcare staff being overworked....as such perhaps the staffing service will still be in demand in HK for a longer period of time. However, the company's corporate actions of purchasing a building and using it as a mini supermarket concept is not something that i am fond of.

Kato HK should benefit due to the operations of the Expo although it is hard to ascertain its exact revenue model and number of years of contract as well as how to judge its profitability. In terms of its aged care business, it is a traditional business with margins that are slowly dropping over time and any catalyst has to come from the government side of things. However, with covid being quite serious in aged homes as well, it is unlikely anyone will be allowed to shift out of the aged homes in this period. The occupancy rate is likely anchored.

Wednesday, 16 February 2022

Shinvest Offer Price 3.50 Thoughts

A take-over offer was announced for Shinvest at the price of $3.50 per share

Although this stock is not mentioned frequently on my blog post, readers who click on my portfolio details will know that it is 1 of my top 3 holdings. It has been a position i have been holding since 2018 and personally there is a behind story to how i know about the stock.

It is also the 1st time in my portfolio there is a takeover offer.

In my opinion, the offer price is probably somewhat unacceptable. I will be listing down the reasons why.

1. Offer range prices Espressif Shares at 124 RMB

The company has $1.28 net cash per share as of latest balance sheet. Deducting the $0.03 dividend, this results in $1.25 net cash per share.

This implies that Espressif is and Other net assets (around $0.86 per share) is valued at $2.25 per share. To add on, this implies that the business is actually worth 0 as well. Not that the business is profitable but it should still worth some liquidation value.

Lets take the worst case scenario that other net assets are worth 0. This means that 2,804,446 Espressif Shares are valued at $67,286,749.50

This results in a number of 317 million yuan. Which implies each Espressif Share is valued at 113 RMB.

However, we have to account for a possible deferred tax of around 9.42% when the shares are sold. Hence it values each share at around 124 RMB.

As of 16 February 2022, Espressif traded at 148 price. As such this offer price is actually unattractive.

In fact, at this offer price. The total net asset value of the company is around 4.36. hence i feel that a better offer should be at 3.88 instead since its Chinese New Year

2. Current Espressif Shares values the company at 3.96 (net cash + Espressif) and Total NAV 4.82

As such, the offer price of $3.50 is way below the price that the company can payout if it sells already the shares.

3. Espressif Shares trading at a lower range.

If there is a word to describe Espressif Share Price, it would be volatile. As over a year period, it has traded from a range of 97 to 296

As such, the price of $150 is already at a lower end. Which implies that there should be valuation upside.

Will the offer hit 90%?

This is an interesting question. There is a gap time between the sending of the offer letter and accepting it etc. As such, everyone will be attaching a closer eye to the share price of Espressif.

In volatile times, there are times where Espressif shares have risen up by 28% in a week. If such things happen, i am pretty sure people are not inclined to accept the offer and want a better price.

However if Espressif starts diving down, people might be inclined to offer their shares.

Looking at the shareholding structure, the top 20 shareholders can agree to tender their shares and it still will not hit 90%. Another 11.36% is required.

Doing some math, 116 shareholders control 94.08% shares. Top 20 controls 78.64% with offering party having 29.02%.

96 Shareholders actually hold a total of 15.44% shares which is quite interesting because 11.36% is needed either from here or 9.52% if all the smaller shareholders agree to sell.

Its quite interesting as the 96 shareholders probably have a role to play as well. Its also the first time i actually hold more than 0.01% of the company even though i do not hold a big amount of shares among the 96 people.

I highly doubt they will hit 90% but i might be wrong.

Conclusion

I might be inclined to sell my shares. But if Espressif is trading at $150 RMB, then a better offer needs to be given. Especially considering the prospects of Espressif and the net cash position of the company.

Lastly, their freehold shop house is not talked about as no transaction has been done at the similar building. However, given that a similar sized is asking for rental of $5000. A full year rental should be around $60000 and their current net carrying amount of $702000 should be slightly undervalued.

I hope the IFA do their job and value the company appropriately.

*Just for laughs, if Espressif makes its way back to the peak of 296 RMB, then the Net Cash +Espressif stake is worth $6.59 per share.

Thursday, 10 February 2022

GRP Limited Results Thoughts

GRP Limited (SGX: BLU ) released its half year results. On first glance, results are much worst off as losses have deepened.

This is one of the first companies that i will be sharing my thoughts as there will likely be more results releasing in this month and next month.

The company is still progressing in their affordable housing in Malaysia and it is still work in progress. It probably will take up to end of 2024 for the project to be done hence there is still some way off.

Therefore while the company is still in a loss making position, the company has cash of 24m and liabilities of 8.1m. This means that net cash is 8.8 cents. The company is trading at below net cash and at a healthy level. With the cash position, it is able to take on more affordable housing projects if it wants to.

Overall, the result is not sexy nor exciting and certainly not good either. It is on the lower end of results as there has been the unexpected penalty from attempting to do foreign exchange transaction that are not according to the laws in China.

I will still continue to monitor and see the progress of the company if it is able to obtain more affordable housing projects in Malaysia as well as its current project.

Tuesday, 1 February 2022

(January 2022 Results) How i would invest in the singapore stock market if i had 100k of spare money

Commentary

All stocks trended lower in January. In a rare happening although its a bad one. To make things more puzzling, STI is positive in January with a 3.54% return. Large cap stocks like Singtel, DBS and Keppel Corp have turned in positive returns as well.

In the portfolio, UMS and IFAST have corrected over 20% in January alone. Both are relatively good gainers in 2021 hence it seems to be not a surprise. After all tech related companies are the fastest to fall when interest rate news impact the markets.

Overall, looking at how other markets have went, i would say the results are not unacceptable nor shocking. More importantly will be how the results go in February for some of the companies.