Company Introduction

Kwoon Chung Bus Holdings is a transport operator in HK and China. Its main line of business are as follows

1) Operating of Public Bus Service in HK (Under New Lantao Bus 'NLB')

2) Operating of Non-Public Bus Service in HK (Under the Kwoon Chung Brand)

- An example of this would be providing bus services to transport kids to school and from school to a stop near their home.

3) Operating of Cross-Border Transport Services (Bus / Private Vehicle) (HK - Macao - China)

-An example can be from Hong Kong to Shenzhen / Macau / Zhuhai / Qian Hai / Zhongshan

4) Operation of the Bipenggou Tourism Site and a Hotel in China.

-Bipenggou is a tourism site in Sichuan.

Company Financials

A look at financials and folks can tell that it has not been good for them in the past years

Revenue (2.1B in 2024 vs 2.97B in 2019) is still lower than pre-covid and profitability (32m in 2024 vs 253.6m in 2019) is far lagging behind.

Thesis

A turnaround play riding on an interesting theme. It is worth betting that the half year result ended 30 September 2024 would surprise on the upside.

This theme is known as 北上 . It is a phenomenon that has hit Hong Kong in recent times , which is HK Folks heading up to parts of China during weekends and even on normal days to spend time / money there.

The reason for heading up to parts of China can be broken into 2 parts.

Part 1: Things are cheaper there and are more value for money.

(Dentist and Food is much cheaper there)

(Even meds is much cheaper there)

I am sure folks from Singapore will resonate to this because of neighboring effect.

Part 2: Accessibility has greatly improved

There are now many ways to go into China. With the HK Macau Zhuhai Bridge as well as the Zhongshan Shenzhen Bridge, these has improved accessibility for folks to go into China.

Reasons for Buying into this Thesis.

1) Cross Border Numbers has greatly increased.

Macao Crossing Data from April 2024 to July 2024 is the highest since Covid.

(Shenzhen Bay Crossing Traffic has increased in general the past 4 months as well.)

(Trend still going strong)

2) NLB Bus Ridership has recovered.

While it is not back to 2019 levels, it is getting close. From April 2024 to July 2024, the numbers are much higher than the same period in 2023 as well.

3) Price increase still seen in Non-Public Bus Segment. International School Population in HK has hit record high.

(23/24 $17810)

(24/25 $18830) An increase of 5.7%

It is good to see that there is still price increase in the services each year. Although the company does not provide a breakdown to which how much does transport services for student make up for this sector.

(While it might not be a strong link, it is good to hear that there has been higher amount of students in the segment that the non-public bus segment operates in)

Conclusion

I think it will be a better half for Kwoon Chung. But it might be really difficult to estimate the revenue because how much it will be able to capture in the cross-border demand.

If it is able to go back to its pre-covid profitability or even exceed it, it is definitely cheap as i think the trend of folks going up to China to spend will continue.

I think there might be some concerns because of its balance sheet being some more levered as it is a business that has high operating leverage (buses) and it is funded via borrowings as well.

As such, the execution might not be as easy as it seems but i still see it as a business with high operating leverage that should benefit much more from increased ridership.

Considering the above factors and my portfolio as a whole, i have decided to allocate some % to this stock.

I am capping my exposure for this stock at a max of 15% of my assets. But as of now, it is not at double digits in terms of weightage.

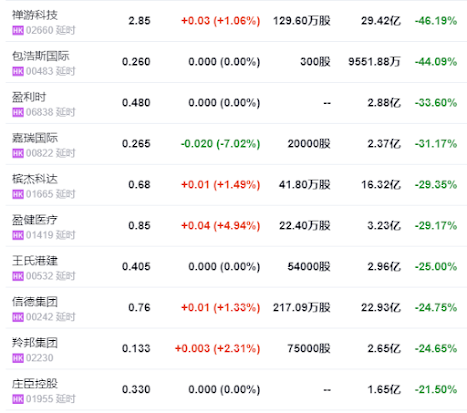

Other stocks that could ride this theme that i have considered are as follows.

Travel Expert (1235 HKEX) - Tour Package Operator. However, unsure how much it benefits from cross-border travel even though it runs a platform that sell cross-border related packages. Its packaged tour has recorded good growth and September Tour Group is a record high.

Faces problems of ultra low liquidity and 1H / 2H 's revenue and gross profit margin has high variations. As such I am unsure if it would benefit from higher revenue.

Transport Intl (62 HKEX) - Operator of KMB. While KMB does serve cross border, it still has a much larger focus in domestic operations

Hans Energy (554 HKEX) - Recent acquisition of Citybus in HK makes it a relevant play. However, gearing becomes rather inflated after the acquisition of Citybus and Citybus falls under the same category as KMB so the cross border exposure is smaller.

MTR Corp (66 HKEX) - Considering this stock is up 20+% in the past months and also a large cap that is related to the market sentiments. I had my reservations. However, its patronage data does indicate a better 2H and it also has a good pipeline of property revenue to recognize.

At 18 PE.......it is almost priced for growth in the 2H as well. Though I have to say this is definitely a much direct beneficiary from the 北上 theme and it is a safer company (structure of shareholding , ease of tracking the patronage data etc)

HSI PE.

(MTR Patronage Figures) As you can see, Jul and Aug Cross boundary and HSR figures have improved. I believe Sept figures should be much higher due to golden holiday effect.

K-Pop Pictures Spam Time😂

It has been way too long since i saw this group.

Also some spam of photos from my recent trip

(IN-N-OUT is really good)

(Panda Express is decent)

(BCD Tofu at where it started.......LA)

Seems like a photo spot for many

As usual, if you can stand the Pictures spam and reach here.....i would provide my non accurate prediction of the revenue of the company

I think the China tourism segment should see around 10% growth.

Limousine and Non-franchised bus should see around 20% growth.

Franchised Bus would see slight decline of around 3-5%.

The hardest to predict would still be Nonfranchised Bus and Limousine as well as how much of this increased revenue seeps into profit.

With the opening of Shenzhen -Zhongshan bridge on 30 June 2024 and the strong outbound travel from HK to China figures seen in Sep.....it makes the forecast difficult.