HK and China Markets have gotten a lot of interest / writing and video coverage in the past weeks.

2800 HKEX the tracker fund has rised by 22% in the past month. There has been many reasons given for this increase..........from fiscal stimulus / under allocation to HK / China to covering of short interest and buying power increased as China Financial Institutions are given the 'free-pass' to buy stocks / golden holiday strong demand...... the list goes on

My personal thoughts are that the focus should still be on individual stocks. Perhaps one should ask if there is a fiscal stimulus, does that affect your company.....if your company is Link Reit for example, will fiscal stimulus affect the HK Property Demand?

Or maybe another example will be Mainland Holdings where at least 85% of revenue is from US. It is unlikely to benefit from any fiscal stimulus from China

I think trying to understand the link between policy to individual companies will be more key.

I think it is rather scary if you have a company that trades at 20 PE and after a 30% rally now it trades at 26 PE. There is more focus needed to think about the link and whether this company can deliver growth because if it does not, the sell down will likely happen.

However if you have a company that is 4 PE...a 30% rally gives the stock a 5.2 PE....which will probably be cheap if it is not cyclical or still represents a lesser risk compared to a 26 PE.

The level of growth being priced in for both cases are likely to be different.

From a more abstract POV, China's PE after the recent increase is still 10% lower than the 10 years average

But if you look at HK PE, it seems to be slightly overvalued around 8%

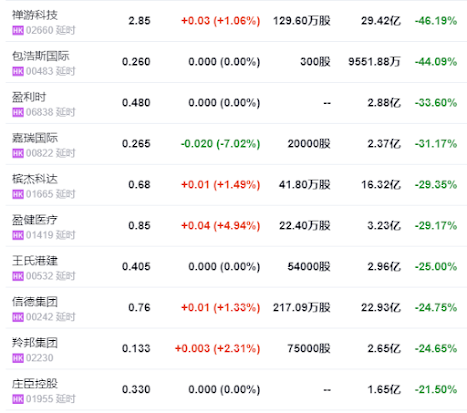

In my watchlist, there is still companies that show negative share price performance this year while the tracker fund has rallied 29% this year

Perhaps i will start some dumpster diving for some stocks that have underperformed the market this year and might show good results.

As a whole, the rally is good and perhaps some small cap stocks might catch the eyes of investors who wants to invest in the hk markets but does not want to go into the large caps like the rest

But on a company business / financial performance level, policies have to be actually in place , well articulated and approved before we know if they will see growth from the policies.

No comments:

Post a Comment