HG Metal has been a position that i have added in 2022 and so far my gains and losses are +/- 3%.

It has presented a decent result in 1H 2022 with eps of 5.12 cents. Should it continue its trend, it will mean that earnings come in at around 10 cents and trading at a PE of less than 4 as its trading price is 39 cents.

Furthermore, the net asset value of the company stands at 89 cents.

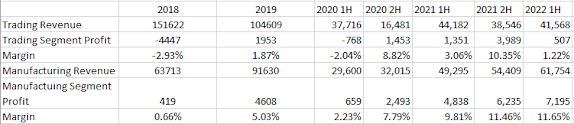

Ever since 2019, the company has shifted its focus from trading to manufacturing. This can be seen in its manufacturing segment profit growing since 2019 while its trading segment has had mixed results.

Manufacturing Profit growing while Trading Segment has mixed results.

In thinking about how the earnings might go in the second half, i decided to take a look at 3 things.

1) Steel Rebar Prices

2) Steel Rebar Demand

3) Competitor

1) Steel Rebar Prices

The average price of steel in 2022 2H is 1060, which is higher than 2021 1H where it started recording decent earnings of 4 cent EPS. However, it is lower than 2021 2H and 2022 1H. Which means that the trading segment might face some losses due to the volatile steel price movements.

However it is all too difficult to predict as the trading segment faced losses in 2018 despite a flat steel price environment and prices was higher than 2017 while in 2019 it managed to have profits despite 2018 2H > 2019 1H > 2019 2H for steel prices.

All things considered, i consider the retracement of steel prices to be rather healthy and it is good for construction demand. A thing worth noting is that steel prices have rise again in 2023 and is up around 10+% in China (A country which SG Imports steel from)

2) Steel Rebar Demand

According to the BCA Free Info, demand for Rebar Steel in 2022 (Up till November) has already exceeded 2020 and 2021. Making it the strongest year since Covid Struck.

Of course it is unlikely to surpass 2018 and 2019 levels but HG Metal's 2021 manufacturing revenue has increased beyond 2019 levels which shows that it has managed to grow despite the macro environment not recovering to those highs.

As such, i expect the manufacturing segment to show some growth or at least maintain stable.

3) Competitor

BRC Asia is its competitor and the market leader in the industry.

Despite some reversal in contracts, it has recorded a relatively strong gross profit and net profit from July to Sept 2022.

This means that business is stable although it has highlighted the BCA Heightened Safety Requirement which might play a part moving forward.

Wild Card Consideration (Resignation of the CEO)

Interestingly, the CEO does not hold any shares in the company and he has resigned while the major shareholder will take up the position of the CEO.

I have to applaud the efforts of the leaving CEO as since joining in Jan 2019, he has turned the ship well and recorded profits in 2019, 2020 and 2021.

He is also paid well in 2021 (1.5 to 1.749m) when the company recorded 12.1 million profit.

In 2020, he is paid (0.25 to 0.499m) when the company recorded 1m profit.

In 2019, he is paid (0.5 to 0.75m) when the company recorded 0.8m profit.

Conclusion

I feel that 2022 results will be stable. Following which then there is probably 3 scripts that the company might follow

Script A - A company that does well when steel prices are up and a lot depends on the increase of steel prices moving foward. In this case, 2022 2H will likely be weak due to lower moving steel prices and the volatility is far lesser.

Script B - The company continues to benefit from its manufacturing segment and is able to offer the value preposition while the tailwinds of 2023 demands being stable and 2022 demands being good offer a re-rating of share price.

Scrip C - A change in CEO results in the company moving backwards instead. Might mean there are some setbacks in the manufacturing business. This means that 2022 might be its last good year for some time.

Of course none of the scripts might happen as well. That is the nature of some sgx small caps where info is very difficult to find and even with info the estimation might be off. As such, it explains why its sizing in the portfolio is around 8+%.

Just hoping that the company will pay a good dividend and be able to produce decent results moving forward after their company trip in July 2022 to Langkawi.

and BRC given out 6 months bonus

ReplyDeleteThanks for info.

Delete