Its the end of the month again. Which means its time for the tallying.

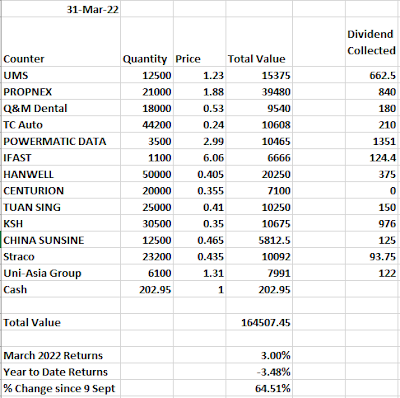

March 2022 Returns: 3.00%

Year to Date Returns: -3.48%

Since Inception (9 Sept 2020) Returns: 64.51%

The main performers for the month are Uni-Asia and Propnex. Meanwhile detractors include China Sunsine and Hanwell. All in all, a good month as the portfolio recorded a good performance

The biggest things to consider this month will be the relaxation policies introduced in Singapore. With group sizes increasing and travelling overseas made more convenient. There are a couple of considerations especially as this month reopening stocks have seen an increase in share price following the news.

As such, having given some thoughts, i have decided to make some amendments to increase the risk in the portfolio.

Exit Positions : Q&M Dental and Hanwell

Added Position: China Sunsine , TC Auto

Entry Positions: LHN Limited

Rationale for Addition: I believe that automobile consumption will increase in 2022, since 2021 has been a supply crunch and in 2022 the Covid-19 woes will likely result in more pent up demand once the covid situation has eased.

As such, i believe both China Sunsine and TC Auto which have low PE and is largely related to the China Auto Industry will benefit.

LHN Limited is a bit of a wild card. Its core PE is around 10-13 and it has a spinoff happening.

The company's segments of co-living, industrial, commercial, facilities management have a decent positive effect from the reopening.

Co-Living is likely to benefit as country opens up and more expats/individuals travel from aboard to Singapore.

Industrials should see more business activities and finally a higher rental lease.

Commercial should start to recover with higher footfall in public.

Facilities Management such as its car parks should see higher usage.

Of course the impact will always be hard to gauge and there are some downsides to the company such as more than half of its net income is from 'other income'

As well as the commercial and industrial portion has performed relatively poor in the most recent FY.

Also it is an asset heavy company as it owns and manages its co-living sites.

As such, it can be labelled as taking a risk.

Rationale for Exiting Positions: Q&M Dental and Hanwell are companies that i believe would perform better in a more 'closed' borders. The chances of not requiring a PCR Test pre-departure has increased in recent times and the chances of lockdown and snatching of food in Supermarket has greatly reduced. Along with my previously written post on the headwinds faced by Tat Seng Packaging, it all adds up as a good time to exit these positions.

As such the allocation will look like this after the changes.

No comments:

Post a Comment