Company Overview

Company's Business includes Construction, Property Development, Toll Road, Quarrying, Construction Materials and Asset Management

Holds 41.53% in Road King Infrastructure (HKEX: 1098) and 55.60% in Build King Infrastructure (HKEX: 0240) as of 31 December 2017.

Profit Mix

- Most of its profits comes from its contribution of its associate (Road King).

- Wai Kee's share of profits from Road King accounted for 78% of Profit Before Tax

- The rest of the profits comes from Construction, Construction Materials and Property Fund segments.

-However the quarrying segment is loss making but according to management has synergies with its construction segment.

Financial Numbers

As of 3 April the stock trades at $4.60 HKD

PE: 4

P/BV: 0.52

Cash On hand - Borrowings: 0.52 HKD

Current Ratio: 1.16

Liabilities to Equity: 61.5%

Current Yield: 5.71% (3.8 cents interim + 22.5 cents final)

Key Risk/ Concerns

-Exposed to possible property measures taken by government amidst the rising property price in China.

-Toll Roads in China are highly competitive businesses with many other players listed as well.

- Construction and Property Development Sector known to by cyclical, with both Road King and Build King recording record profits, expectations could be high and failure to meet it could affect Wai Kee indirectly

My Case for Undervalued

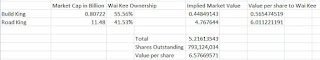

- Trades at steep discount to market cap of its holdings.

In fact its share in Road King exceeds is current trading price. Which means purchasing Wai Kee gets a discounted Road King share, 'free' Build King and 'free' available for sale financial assets

-Build King Order Book has significantly improved.

Secured over 12 billion HKD of projects and has outstanding value of work on hand of 18 billion HKD as of 31 December 2017 (31 December 2016: 12 billion) .

Revenue of 6 billion HKD in 2017, Company should have enough work to get over the next 2-3 years.

Furthermore gross margins held steady despite provision for losses of 2 projects. The lack of such provisions coupled with increased order book should signify growth in FY 2018

-Repeated Purchase of Build King and Road King in 2018

As of 3 April, Wai Kee has increased its holdings in Build King to 56.01% (previously 55.6%) and holdings in Road King to 42.09% (previously 41.53%) via on exchange transactions. This would have increased the steep discount of Wai Kee to market cap of its holdings as well as bring in additional profit contributions.

Conclusion

It is a known fact that parent companies listed on the HKEX has been trading at steep discount of its holding companies but few have the yield Wai Kee provides which makes it a worthwhile holding as a proxy to both Build king and Road King

Wai Kee has been purchasing shares in Build King and Road King since 2013 and this would definitely contribute more to the bottom line should both companies continue to grow.

Vested at 4.65 HKD

ReplyDeleteAre you willing to know who your spouse really is, if your spouse is cheating just contact cybergoldenhacker he is good at hacking into cell phones,changing school grades and many more this great hacker has also worked for me and i got results of spouse whats-app messages,call logs, text messages, viber,kik, Facebook, emails. deleted text messages and many more this hacker is very fast cheap and affordable he has never disappointed me for once contact him if you have any form of hacking problem am sure he will help you THANK YOU.

contact: cybergoldenhacker at gmail dot com